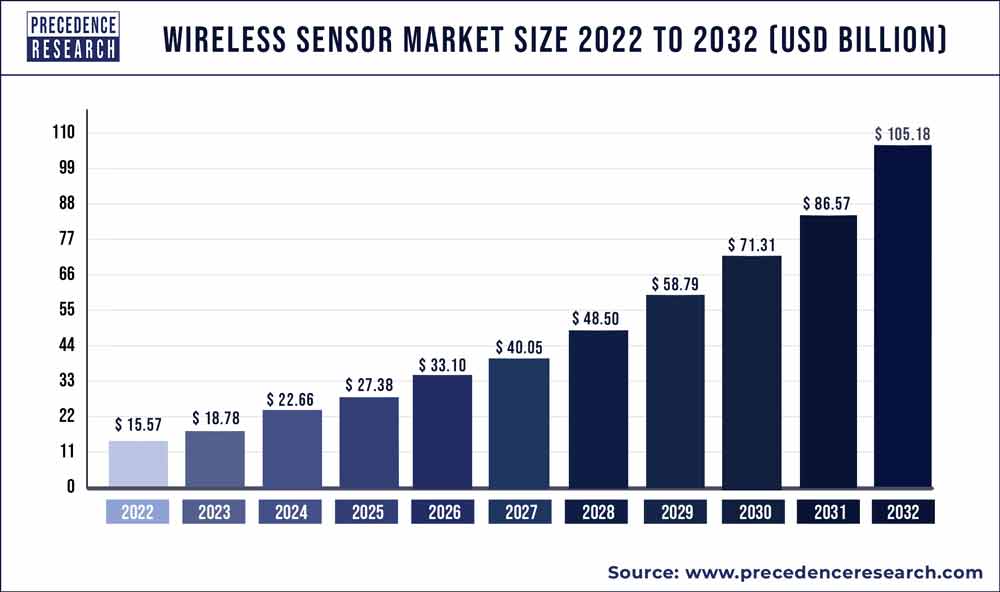

Wireless Sensor Market Boom to $105.18 Billion by 2032

The global wireless sensor market size accounted for USD 18.78 billion in 2023 and is expected to be worth around USD 105.18 billion by 2032, expanding at a CAGR of 21.1% during the forecast period from 2023 to 2032.

Key Takeaways

- North America contributed more than 38% of revenue share in 2022.

- Asia Pacific is estimated to expand the fastest CAGR between 2023 and 2032.

- By product type, the biosensors segment has held the largest market share of 21% in 2022.

- By product type, the level sensors segment is anticipated to grow at a remarkable CAGR of 24.5% between 2023 and 2032.

- By industry vertical, the consumer electronics segment generated over 24% of revenue share in 2022.

- By industry vertical, the agriculture segment is expected to expand at the fastest CAGR over the projected period.

The Wireless Sensor Market is a dynamic and rapidly evolving sector that plays a pivotal role in modern technological landscapes. Wireless sensors, characterized by their ability to communicate without the need for physical connections, have become integral in various industries, ranging from healthcare and manufacturing to environmental monitoring and smart cities. This market is driven by the ever-growing demand for efficient data collection, real-time monitoring, and seamless connectivity across devices.

Get a Sample: https://www.precedenceresearch.com/sample/3621

Absolutely! Let’s start with the overview:

Overview: The Wireless Sensor Market is a dynamic and rapidly evolving sector that plays a pivotal role in modern technological landscapes. Wireless sensors, characterized by their ability to communicate without the need for physical connections, have become integral in various industries, ranging from healthcare and manufacturing to environmental monitoring and smart cities. This market is driven by the ever-growing demand for efficient data collection, real-time monitoring, and seamless connectivity across devices.

Drivers:

IoT Integration: The increasing adoption of the Internet of Things (IoT) is a primary driver for the Wireless Sensor Market. As IoT expands its footprint, the demand for wireless sensors rises to enable seamless communication and data exchange among interconnected devices.

Industry 4.0 Revolution: Industries embracing the fourth industrial revolution are heavily reliant on wireless sensor technologies. The integration of sensors into manufacturing processes enhances automation, efficiency, and predictive maintenance, contributing significantly to the Industry 4.0 paradigm.

Advancements in Connectivity Standards: The continuous evolution of wireless communication standards, such as 5G, Wi-Fi 6, and Bluetooth Low Energy (BLE), empowers wireless sensors to transmit data faster and more reliably. This enhances the overall performance and capabilities of wireless sensor networks.

Energy Efficiency: With a growing emphasis on sustainability, wireless sensors are designed to be energy-efficient, promoting longer battery life or even energy harvesting solutions. This aligns with global efforts to create eco-friendly and low-power consumption technologies.

Expanding Applications: The versatility of wireless sensors is driving their adoption in an expanding array of applications, from smart homes and wearables to agricultural monitoring and environmental surveillance. This diversification contributes to the sustained growth of the Wireless Sensor Market.

Wireless Sensor Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 21.1% |

| Market Size in 2023 | USD 18.78 Billion |

| Market Size by 2032 | USD 105.18 Billion |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Product Type and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Surgical Procedures Market Boom to $5.10 Trillion by 2032

By Product

- Biosensors

- Temperature Sensor

- Pressure Sensor

- Humidity Sensors

- Gas Sensors

- Flow Sensors

- Level Sensors

- Motion and Positioning Sensors

- Others

Wireless sensor technology has revolutionized various industries by offering a diverse range of products tailored to specific needs. In terms of product types, the market encompasses a wide array of sensors designed to meet specific requirements. Temperature sensors, pressure sensors, motion sensors, and environmental sensors are some notable examples. These sensors contribute significantly to data collection, enabling industries to monitor and manage various parameters crucial for their operations.

By Industry Vertical

- Consumer Electronics

- Industrial

- Automotive and Transportation

- Aerospace and Defense

- Healthcare

- Agriculture

- Others

Furthermore, the wireless sensor market extends its influence across different industry verticals. One key sector is healthcare, where wireless sensors play a pivotal role in remote patient monitoring, ensuring real-time health data collection and analysis. In manufacturing, these sensors enhance efficiency by enabling predictive maintenance and facilitating the implementation of smart factories. Agriculture is another sector benefiting from wireless sensors, as they assist in precision farming by monitoring soil conditions, weather patterns, and crop health.

In the realm of smart homes, wireless sensors are integral components, providing automation and security features. The integration of sensors in smart grids is transforming the energy sector, optimizing energy distribution and consumption. Additionally, the automotive industry utilizes wireless sensors for applications such as tire pressure monitoring and vehicle diagnostics, enhancing safety and performance.

Reasons to Purchase this Report:

- Comprehensive market segmentation analysis incorporating qualitative and quantitative research, considering the impact of economic and policy factors.

- In-depth regional and country-level analysis, examining the demand and supply dynamics that influence market growth.

- Market size in USD million and volume in million units provided for each segment and sub-segment.

- Detailed competitive landscape, including market share of major players, recent projects, and strategies implemented over the past five years.

- Comprehensive company profiles encompassing product offerings, key financial information, recent developments, SWOT analysis, and employed strategies by major market players.

Recent Developments

- In 2022, Honeywell introduced an innovative sustainability solution focused on carbon emissions monitoring and optimization, successfully deployed in its own facilities. Utilizing the Honeywell Versatilis™ Signal Scout™ wireless Industrial IoT leak detection sensors, the system allows organizations to monitor emissions in near real-time, aiding industrial sectors in achieving greenhouse gas reduction targets.

- STMicroelectronics, a prominent semiconductor leader, unveiled its third-generation MEMS sensors in February 2022, delivering enhanced performance for consumer mobiles, smart industries, healthcare, and retail. In a collaborative effort with Metalenz Inc. in June 2021, STMicroelectronics embarked on a co-development and license agreement to advance Metalenz’s meta-optics technology for smartphones, consumer devices, healthcare, and automotive applications.

- In March 2020, TE Connectivity successfully completed the public takeover of First Sensor AG, a global player in sensor technology with expertise in chip design and production. First Sensor specializes in developing standard and custom sensor solutions for industrial, medical, and transportation applications.

- Furthermore, in May 2021, Honeywell expanded its portfolio with the development of two robust Inertial Measurement Units (IMU) designed for military and rugged industrial environments. The HG1125 and HG1126 sensors are engineered to withstand extreme shocks, making them suitable for applications with harsh impact scenarios such as ballistics tests.

Wireless Sensor Market Players

- Honeywell International Inc.

- STMicroelectronics

- TE Connectivity Ltd.

- Siemens AG

- Texas Instruments Incorporated

- Emerson Electric Co.

- ABB Ltd.

- Bosch Sensortec

- NXP Semiconductors

- Schneider Electric SE

- General Electric Company

- Analog Devices, Inc.

- Infineon Technologies AG

- IBM Corporation

- Sensirion AG

Segments Covered in the Report

By Product Type

- Biosensors

- Temperature Sensor

- Pressure Sensor

- Humidity Sensors

- Gas Sensors

- Flow Sensors

- Level Sensors

- Motion and Positioning Sensors

- Others

By Industry Vertical

- Consumer Electronics

- Industrial

- Automotive and Transportation

- Aerospace and Defense

- Healthcare

- Agriculture

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/