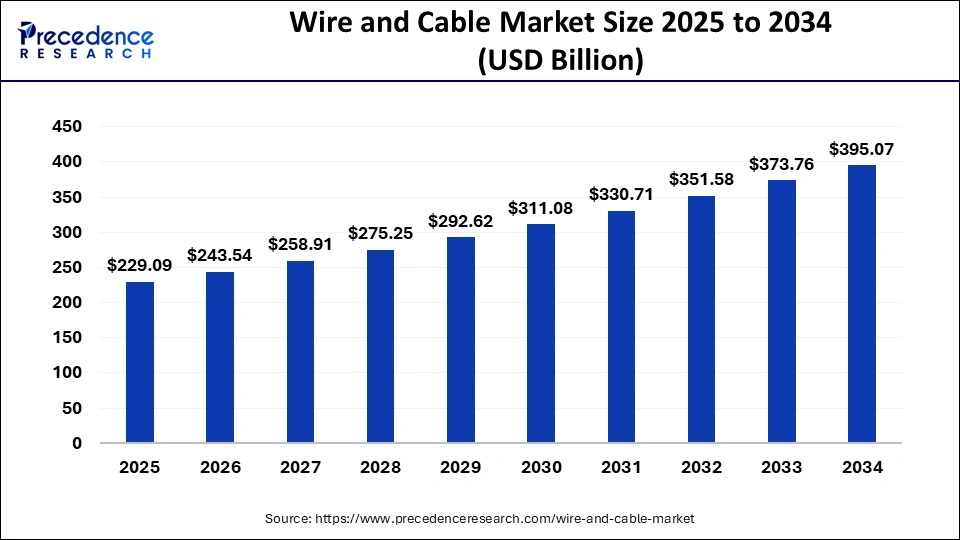

Wire and Cable Market Size to Surpass USD 395.07 Bn By 2034

The wire and cable market size is valued at USD 215.49 billion in 2024 and is predicted to surpass around USD 395.07 billion by 2034, with a notable CAGR of 6.20%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1070

Key Insights

- The Asia Pacific region captured a 38% market revenue share in 2024.

- Low voltage systems contributed the largest portion of revenue, surpassing 44% in 2024.

- Overhead installation dominated the market, generating over 65% of revenue in 2024.

- The energy and power sector led in end-use, accounting for 38% of total revenue in 2024.

- The building and construction sector is expected to expand at a CAGR of 4.9% between 2025 and 2034.

Market Dynamics

Drivers

The expansion of energy distribution networks and increasing electrification in rural areas are key drivers of the wire and cable market. The growing demand for high-speed communication networks, including fiber optics for 5G technology, is further supporting market growth.

Additionally, industrial automation and the proliferation of data centers are driving the demand for advanced cabling solutions. Rising consumer awareness regarding fire-resistant and durable cables is also contributing to market expansion.

Opportunities

The transition towards smart infrastructure and intelligent power distribution systems presents numerous opportunities for cable manufacturers. The increasing adoption of renewable energy and electric mobility solutions is creating demand for advanced power transmission cables.

Technological advancements in cable design, such as self-healing and superconducting cables, offer growth potential. Additionally, increased government funding for infrastructure modernization and rural electrification projects is expected to drive market growth.

Challenges

Price fluctuations in key raw materials like copper, aluminum, and polymers impact production costs and profitability. The wire and cable industry also faces counterfeit products, leading to safety hazards and revenue losses for manufacturers.

Compliance with stringent environmental and safety regulations requires substantial investments in eco-friendly materials and manufacturing processes. Furthermore, disruptions in the global supply chain due to geopolitical tensions and economic fluctuations pose risks to market stability.

Regional Insights

Wire and Cable Market Companies

- Hengtong Optic-Electric Co Ltd.

- Prysmian Group

- Sumitomo Electric Industries, Ltd.,

- Furukawa Electric Co., Ltd.

- Leoni AG

- Jiagnan Group

- General Cable Corporation

- LS Cable & System Ltd

- TPC Wire & Cable Corp

- Southwire Company, LLC

- Polycab Wires Private Limited

- Nexans S.A.

- Hitachi Metals Ltd

- Far East Cable Co., Ltd.

Recent Development

- In January 2023, In compliance with new High Voltage Direct Current (HVDC) recommendations, SuperGrid Institute and Nexans completed a temporary overvoltage test on a 525kV DC cable design. The SuperGrid Institute’s High Voltage testing equipment was used to conduct numerous damped oscillating voltage trials on the Nexans-produced and -installed DC cable system.

- In January 2023, The Voluntary Protection Programs (VPP) Star site designation for Southwire’s El Paso, Texas, facility has been renewed by the Occupational Health and Safety Administration (OSHA).

- In July 2022, the domestic creation, production, and marketing of a liquid-cooled (LC) ultra-fast charging cable were all disclosed by LS Cable & System (LS C&S).

- In May 2022, six new products will be released in Q2 2022, according to Belden Inc., a top provider of specialist networking solutions worldwide. These products will give clients additional integration options, safer ways to transport power over long distances, and quick lead times.

Segments Covered in the Report

By Type

- Medium and High Voltage (MV & HV)

- Low Voltage (LV)

- Optical Fiber Cable

By Material

- Aluminum

- Copper

- Glass

By Installation

- Overhead

- Underground

By Application

- Data Transmission

- Building

- Power Transmission

- Transport

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/