Vaccine Storage and Packaging Market Size to Gain USD 37.39 Bn by 2034

Vaccine Storage and Packaging Market Size and Growth

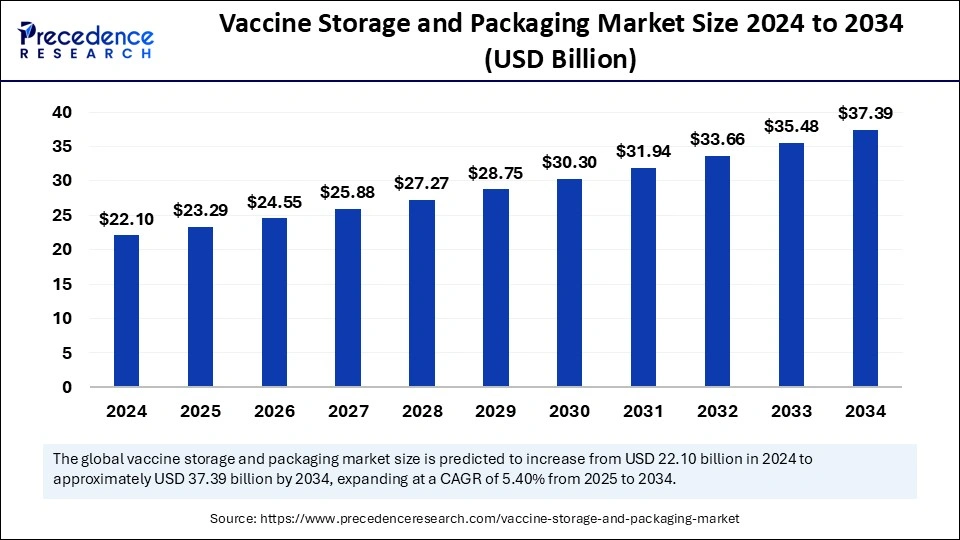

The global vaccine storage and packaging market size is projected to gain around USD 37.39 billion by 2034 increasing from USD 22.10 billion in 2024, with a CAGR of 5.40%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5754

Key Highlights

-

In 2024, North America emerged as the leading market with a 37% share.

-

Europe is expected to record the fastest CAGR during the 2025-2034 period.

-

The vaccine packaging segment was the top-performing product category in 2024.

-

The vaccine storage segment is expected to expand significantly in the forecast years.

-

Plastic-based packaging led the market in 2024.

-

Glass packaging is poised to experience the highest growth rate over the next decade.

-

The pharmaceutical and biotech companies segment commanded a 43% share in 2024.

-

The diagnostic centers segment is predicted to grow at an accelerated pace from 2025 to 2034.

Growth Factors of the Vaccine Storage and Packaging Market

- Increasing Global Vaccination Programs

Government initiatives and immunization programs by organizations like the WHO and UNICEF are driving the demand for advanced vaccine storage and packaging solutions. The rising need for mass vaccinations, especially in response to pandemics and infectious diseases, is fueling market growth. -

Advancements in Cold Chain Logistics

The development of smart cold storage solutions with temperature monitoring, real-time tracking, and automated alerts ensures vaccine efficacy. Enhanced refrigeration technologies and AI-driven logistics are improving supply chain efficiency and reducing vaccine wastage. -

Rising Demand for Biopharmaceuticals

The growing use of biologics and mRNA-based vaccines, which require specialized storage and packaging, is driving market expansion. These vaccines are temperature-sensitive, necessitating reliable cold chain infrastructure and innovative packaging solutions. -

Technological Innovations in Packaging

Advanced packaging materials such as temperature-resistant plastics, smart labels with QR codes, and tamper-proof packaging are improving vaccine safety and stability. The integration of RFID and IoT-enabled tracking systems further enhances packaging security. -

Government Regulations and Compliance Requirements

Stringent regulations regarding vaccine storage and packaging are pushing manufacturers to adopt high-quality materials and technologies. Compliance with Good Distribution Practices (GDP) and Good Manufacturing Practices (GMP) ensures the safe handling and storage of vaccines. -

Growing Investments in Healthcare Infrastructure

Increased funding in healthcare and pharmaceutical industries, especially in developing countries, is improving vaccine distribution networks. The expansion of healthcare facilities and cold storage warehouses is supporting market growth. -

Rising Incidence of Infectious Diseases

The increasing prevalence of infectious diseases, such as influenza, COVID-19, and meningitis, is creating a higher demand for vaccines and their safe storage. Governments and healthcare organizations are prioritizing efficient vaccine storage solutions to ensure readiness for outbreaks. -

Expansion of Pharmaceutical and Biotech Companies

The rapid growth of pharmaceutical and biotech companies, coupled with the rising production of vaccines, is boosting the need for effective storage and packaging solutions. Companies are investing in innovative packaging technologies to enhance vaccine stability and distribution.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 37.39 Billion |

| Market Size in 2025 | USD 23.29 Billion |

| Market Size in 2024 | USD 22.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.40% |

| Dominating Region | North America |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Packaging Material, End-user and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers

Key drivers include the rising incidence of infectious diseases, growing government initiatives for immunization, and advancements in smart cold storage technologies. The continuous development of temperature-sensitive packaging and IoT-enabled monitoring systems has enhanced the efficiency and reliability of vaccine storage.

Opportunities

Opportunities in the market lie in the integration of artificial intelligence and automation to improve logistics and minimize wastage. The expansion of vaccination programs in emerging economies also presents a strong growth potential. Additionally, sustainable and eco-friendly packaging solutions are gaining traction, offering businesses new avenues for innovation.

Challenges

Challenges include the high cost of maintaining ultra-low temperature storage, logistical complexities in remote and developing regions, and the risk of supply chain disruptions. Ensuring vaccine integrity while maintaining affordability remains a key concern for manufacturers and healthcare providers.

Regional Insights

North America holds the largest market share, supported by robust healthcare infrastructure and high vaccination rates. Europe is poised for significant growth, driven by stringent regulatory policies and technological advancements. The Asia-Pacific region is anticipated to experience the fastest growth due to increasing government initiatives, expanding healthcare facilities, and the rising demand for vaccines in densely populated nations.

Vaccine Storage and Packaging Market Companies

- Lineage Logistics

- AmerisourceBergen

- DHL

- DB Schenker

- Cardinal Logistics

- McKesson

- Thermo Fischer Scientific

- PANASONIC HEALTHCARE CO., LTD

- American Biotech Supply

- Arctiko A/S

- NIPRO

Recent Developments

- In August 2024, the Africa Centers for Disease Control and Prevention (Africa CDC) donated Burundi with essential vaccine storage equipment, including 28 electric and solar-powered refrigerators, 20 ice rooms, and 162 transport boxes that are specifically designed for vaccines.

- In January 2024, SCHOTT Pharma introduced glass vials optimized for deep-cold storage of drugs and vaccines.

Segments Covered in the Report

By Product Type

- Vaccine Storage

- Refrigerators

- Freezers

- Vaccine Packaging

- Cold Boxes

- Vials & Ampoules

- Corrugated Boxes

- Bags

- Others

By Packaging Material

- Plastic

- Glass

- Paper & Paperboard

- Others

By End-user

- Pharma and Biotech Companies

- Diagnostic Centers

- Clinical Research Organization

- Other Healthcare Facilities

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Also Read: Fondaparinux Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/