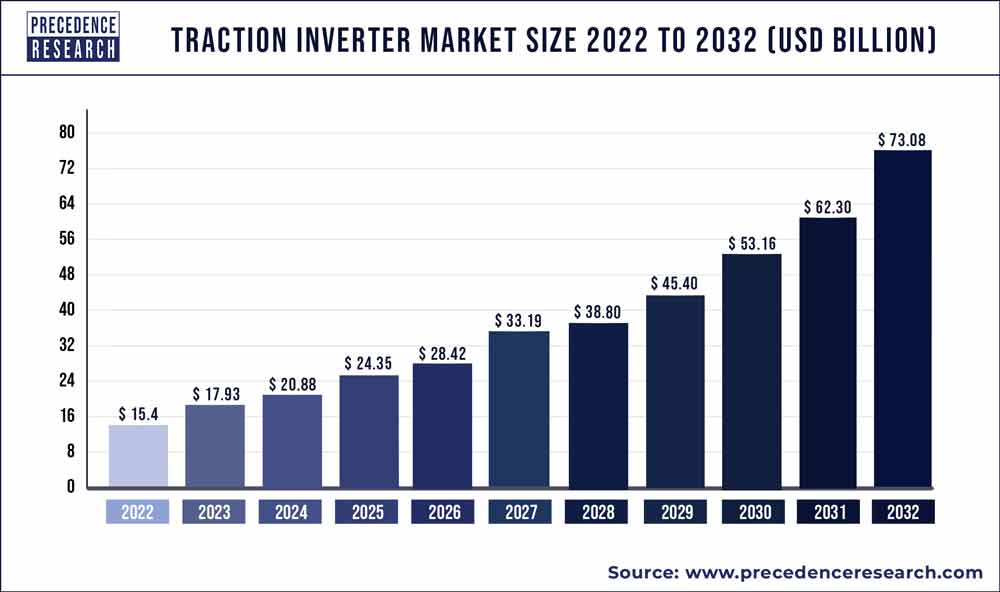

Traction Inverter Market Size To Reach USD 73.08 Bn By 2032

The traction inverter market size is estimated at USD 17.93 billion in 2023 and is expected to reach USD 73.08 billion by 2032, growing at a CAGR of 16.90% during the forecast period.

Key Takeaways

- North America contributed more than 44% of revenue share in 2022.

- Asia-Pacific is estimated to expand the fastest CAGR between 2023 and 2032.

- By propulsion, the BEV segment has held the largest market share of 44% in 2022.

- By propulsion, the PHEV segment is anticipated to grow at a remarkable CAGR of 17.2% between 2023 and 2032.

- By voltage, the 200 to 900V segment generated over 38% of revenue share in 2022.

- By voltage, the 900V and above segment is expected to expand at the fastest CAGR over the projected period.

- By technology, the MOSFET segment generated over 46% of revenue share in 2022.

- By technology, the IGBT segment is expected to expand at the fastest CAGR over the projected period.

- By vehicle, the commercial Vehicles segment generated over 42% of revenue share in 2022.

- By vehicle, the passenger cars segment is expected to expand at the fastest CAGR over the projected period.

The Traction Inverter Market is a dynamic sector at the forefront of modern transportation. Traction inverters play a pivotal role in electric vehicles and hybrid systems, converting DC power from batteries into AC power to drive electric motors. As the global automotive industry undergoes a transformative shift towards sustainable mobility, the demand for efficient and reliable traction inverters has surged. This market’s growth is not confined to traditional automobiles alone; it extends its influence across electric trains, buses, and various industrial applications, reflecting a broader transition towards electrification.

Get a Sample: https://www.precedenceresearch.com/sample/3579

Drivers

- Rising Electric Vehicle Adoption: With an increasing emphasis on reducing carbon emissions and mitigating climate change, the automotive landscape is witnessing a rapid adoption of electric vehicles (EVs). Traction inverters stand as a critical component in EVs, driving demand in tandem with the burgeoning green transportation movement.

- Government Initiatives and Incentives: Governments worldwide are implementing policies and incentives to promote electric mobility. Subsidies, tax credits, and regulatory measures supporting electric vehicles propel the traction inverter market forward, as manufacturers strive to meet the growing demand spurred by these favorable conditions.

- Advancements in Technology: Ongoing technological advancements have led to the development of more efficient and compact traction inverters. Innovations in power electronics, thermal management, and control systems contribute to enhanced performance, longer battery life, and reduced overall costs, further stimulating market growth.

- Expansion of Public Transportation Electrification: The electrification of public transportation, including buses and trains, is gaining momentum. Traction inverters play a crucial role in these applications, contributing to the electrification of mass transit systems worldwide. As cities prioritize sustainable urban development, the market for traction inverters continues to expand.

- Collaborations and Partnerships: In response to the complex challenges of developing advanced traction inverter systems, industry players are increasingly forming collaborations and partnerships. These alliances foster knowledge exchange, accelerate innovation, and ensure a steady supply chain, driving the market’s evolution and competitiveness.

Traction Inverter Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 16.90% |

| Market Size in 2023 | USD 17.93 Billion |

| Market Size by 2032 | USD 73.08 Billion |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Propulsion, By Voltage, By Technology, and By Vehicle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Propulsion:

- BEV

- HEV

- PHEV

- Others

The Traction Inverter Market is diversifying based on propulsion systems, with a notable shift towards electric and hybrid vehicles. The demand for traction inverters in electric propulsion systems is on the rise as the automotive industry responds to the global push for sustainable and eco-friendly transportation solutions. Hybrid vehicles, combining both traditional internal combustion engines and electric power, also contribute to the growth of this segment.

By Voltage:

- Up to 200V

- 200 to 900V

- 900V and above

Voltage segmentation plays a crucial role in the Traction Inverter Market. Different voltage categories cater to various vehicle types and performance requirements. Low-voltage traction inverters are commonly found in mild-hybrid and entry-level electric vehicles, while high-voltage systems are prevalent in full electric and high-performance hybrid vehicles. This segmentation reflects the industry’s efforts to balance efficiency, power delivery, and overall vehicle performance.

By Technology:

- IGBT

- MOSFET

- Others

The Traction Inverter Market is witnessing advancements in technology, contributing to improved efficiency and performance. Silicon-based technology has been a staple, but the industry is rapidly transitioning towards silicon carbide (SiC) and gallium nitride (GaN) technologies. These advanced materials offer higher power density, reduced energy losses, and overall improved efficiency, addressing the growing demand for energy-efficient electric vehicles.

By Vehicle:

- Passenger Cars

- Commercial Vehicles

- Others

Segmenting the market by vehicle types provides insights into the diverse applications of traction inverters. Passenger cars, commercial vehicles, and two-wheelers each have unique requirements. Passenger cars increasingly incorporate traction inverters to power electric drivetrains, while commercial vehicles are adopting these systems for a greener and more cost-effective fleet. Two-wheelers, especially electric motorcycles and scooters, contribute to the market’s expansion, driven by the growing popularity of electric mobility solutions.

Read Also: Styrene Butadiene Latex Market Size To Grow USD 16.66 Billion by 2032

Recent Developments

- In July 2022, Curtiss-Wright expanded its industrial division, introducing a new lineup of products within the traction inverter sector. This expansion notably includes traction inverters designed for both hybrid and pure-electric on-highway and off-highway commercial vehicles. The focus on efficiency and innovation underscores Curtiss-Wright’s commitment to advancing electric mobility solutions. By diversifying its product portfolio in the traction inverter market, Curtiss-Wright aims to cater to the growing demand for advanced electric propulsion systems in the commercial vehicle sector, aligning with the global trend toward sustainable and eco-friendly transportation.

- In June 2022, STMicroelectronics (ST) and Semikron joined forces to create a Silicon Carbide (SiC)-powered semiconductor, specifically designed for electric vehicle traction drives. This collaborative effort signifies a strategic move to propel advancements in automotive traction inverter technologies. Silicon Carbide, known for its superior performance in power electronics, is expected to enhance the efficiency and capabilities of traction inverters in electric vehicles. By leveraging the expertise of both STMicroelectronics and Semikron, this collaboration aims to contribute to the evolution of cutting-edge solutions, supporting the automotive industry’s shift towards more efficient and sustainable electric propulsion systems.

Traction Inverter Market Players

- Siemens AG

- Infineon Technologies AG

- Continental AG

- Robert Bosch GmbH

- Delphi Technologies

- Hitachi Automotive Systems

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Fuji Electric Co., Ltd.

- ABB Ltd

- Dana Incorporated

- Lear Corporation

- Texas Instruments Incorporated

- STMicroelectronics

- ON Semiconductor

Segments Covered in the Report

By Propulsion

- BEV

- HEV

- PHEV

- Others

By Voltage

- Up to 200V

- 200 to 900V

- 900V and above

By Technology

- IGBT

- MOSFET

- Others

By Vehicle

- Passenger Cars

- Commercial Vehicles

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/