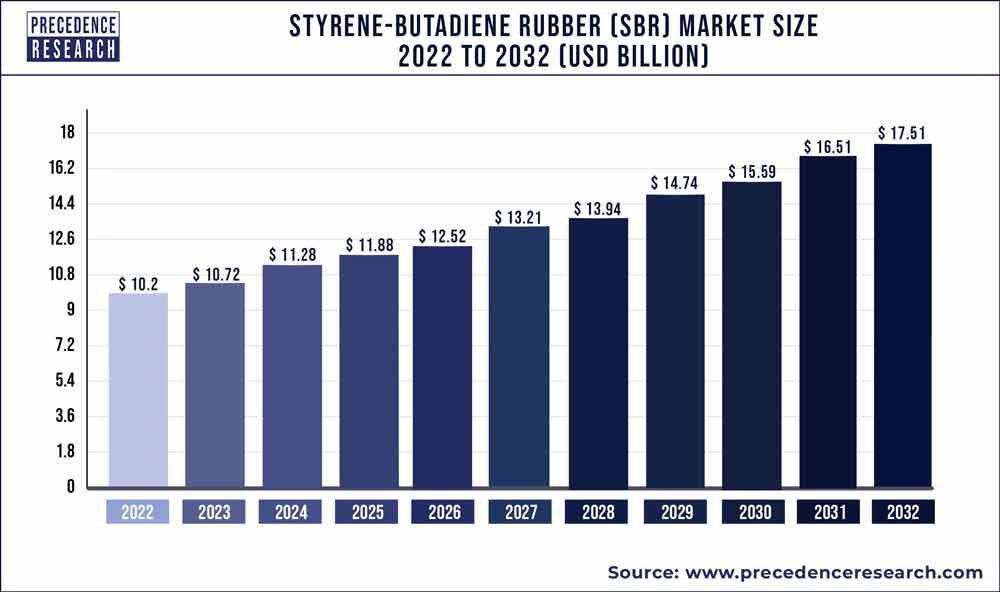

Styrene-Butadiene Rubber Market Size To Grow USD 17.51 Bn By 2032

The global styrene-butadiene rubber (SBR) market size was estimated at USD 10.72 billion in 2023 and is projected to hit around USD 17.51 billion by 2032, registering a CAGR of 5.60% during the forecast period from 2023 to 2032.

Key Takeaways

- Asia-Pacific contributed more than 33% of revenue share in 2022.

- North America is estimated to expand the fastest CAGR between 2023 and 2032.

- By type, the emulsion SBR segment has held the largest market share of 65% in 2022.

- By type, the solution SBR segment is anticipated to grow at a remarkable CAGR of 6.5% between 2023 and 2032.

- By application, the tire segment generated over 31% of revenue share in 2022.

- By application, the footwear segment is expected to expand at the fastest CAGR over the projected period.

Styrene-butadiene rubber (SBR) holds a pivotal position in the global rubber industry, being a widely used synthetic rubber variant. SBR is produced through the copolymerization of styrene and butadiene, resulting in a versatile material with a balanced blend of properties. Its popularity stems from its cost-effectiveness, durability, and versatility, making it a preferred choice in various applications across industries.

Get a Sample: https://www.precedenceresearch.com/sample/3580

Drivers

- Automotive Industry Surge: The automotive sector’s robust growth continues to be a major driver for the SBR market. SBR’s resilience and cost efficiency make it a preferred material for manufacturing tires, hoses, and gaskets in the automotive industry. As the global demand for vehicles rises, so does the need for SBR, contributing significantly to its market expansion.

- Construction Boom: SBR’s durability and weather resistance make it an ideal choice for construction materials. From roofing materials to sealants and adhesives, SBR plays a vital role in enhancing the longevity and performance of construction products. With an upswing in construction activities globally, the demand for SBR is propelled by the thriving construction industry.

- Consumer Goods Manufacturing: The consumer goods sector, encompassing products like footwear, conveyor belts, and industrial hoses, heavily relies on SBR. Its versatility allows manufacturers to create products with desirable characteristics, meeting consumer demands for quality and durability. The steady growth of the consumer goods industry continues to be a key driver for the SBR market.

- Infrastructure Development: SBR’s applications extend to infrastructure projects, including the production of road surfaces and polymer-modified asphalt. As countries invest in upgrading and expanding their infrastructure, the demand for SBR in construction materials is on the rise. The material’s ability to enhance the performance of asphalt and related products contributes significantly to its market growth.

- Global Economic Expansion: The overall economic growth and industrialization worldwide play a crucial role in the SBR market dynamics. As economies expand, there is an increased need for raw materials and products, driving the demand for SBR across various sectors. The material’s cost-effectiveness further positions it as a preferred choice in both developed and emerging economies.

Styrene-Butadiene Rubber (SBR) Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 5.60% |

| Market Size in 2023 | USD 10.72 Billion |

| Market Size by 2032 | USD 17.51 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Type:

- Emulsion SBR

- Solution SBR

Styrene-butadiene rubber (SBR) is classified into two main types, emulsion SBR (ESBR) and solution SBR (SSBR). Emulsion SBR is produced by a process where styrene and butadiene are polymerized in water. It is known for its versatility and is commonly used in the production of tires, footwear, and various molded goods. On the other hand, solution SBR is manufactured through a solvent-based process, resulting in a rubber with enhanced properties such as improved wear resistance and better compatibility with other rubber types. This type finds applications in high-performance tires and specialized rubber products.

By Application:

- Tires

- Adhesives

- Footwear

- Other Applications

The applications of Styrene-Butadiene Rubber (SBR) span across various industries. One major application is in the tire manufacturing sector, where SBR is extensively used to enhance the performance characteristics of rubber compounds, contributing to improved traction, durability, and fuel efficiency. Additionally, SBR is employed in the production of footwear, conveyor belts, hoses, and other industrial goods due to its favorable balance of properties. In the construction industry, SBR is utilized in adhesives and sealants, showcasing its versatility. The market for SBR in different applications continues to evolve as technological advancements drive innovation in rubber-based products.

Read Also: Traction Inverter Market Size To Reach USD 73.08 Bn By 2032

Recent Developments

- In February 2023, Arlanxeo inaugurated a new polybutadiene (PBR) production line with a capacity of 65 kilotons per annum in southern Brazil. The expansion aims to enhance the rubber production flexibility at the Triunfo facility, reflecting the industry’s commitment to meeting increasing demand for rubber products.

- In November 2022, Asahi Kasei Corporation commenced the sale of Tufdene S-SBR and Asadene BR, both produced using the mass-balance method, at its facilities in Singapore and Kawasaki. The sale is underpinned by the ISCC PLUS2 certification obtained in October 2022, signaling a commitment to sustainable and responsible production practices in the synthesis of styrene-butadiene rubber and butadiene rubber.

Styrene-Butadiene Rubber Market Players

- Lanxess AG

- Sinopec

- Kumho Petrochemical Co., Ltd.

- Asahi Kasei Corporation

- The Goodyear Tire & Rubber Company

- LG Chem

- JSR Corporation

- Trinseo

- Michelin

- Bridgestone Corporation

- Versalis S.p.A. (Eni)

- Synthos S.A.

- Zeon Corporation

- Nizhnekamskneftekhim

- Eastman Chemical Company

Segments Covered in the Report

By Type

- Emulsion SBR

- Solution SBR

By Application

- Tires

- Adhesives

- Footwear

- Other Applications

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/