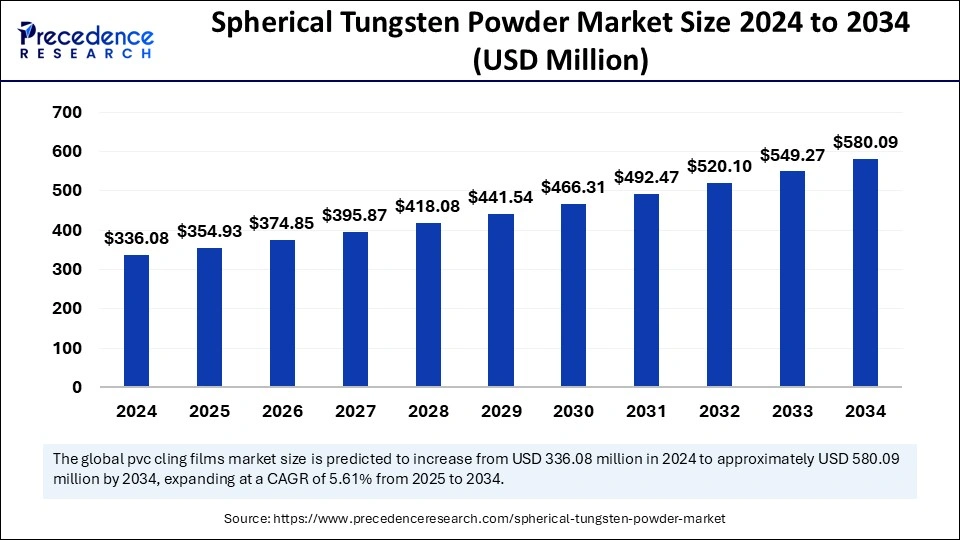

Spherical Tungsten Powder Market Size to Surpass USD 580.09 Million by 2034

Spherical Tungsten Powder Market Size and Forecast 2025 to 2034

The global spherical tungsten powder market size was valued at USD 336.08 million in 2024 and is expected to Surpass around USD 580.09 million by 2034, growing at a CAGR of 5.61%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5756

Spherical Tungsten Powder Market Key Points

-

The Asia Pacific region dominated the spherical tungsten powder market with a 41% share in 2024.

-

North America is predicted to register significant growth during the study period.

-

The fine particle size segment led the market in 2024.

-

The coarse particle size segment is projected to expand at the fastest pace.

-

Thermal spraying applications held the highest market share in 2024.

-

The 3D printing segment is expected to achieve the highest growth rate.

-

The aerospace industry remained the primary consumer of spherical tungsten powder in 2024.

-

The electronics sector is forecasted to witness the most rapid growth.

Role of AI in the Spherical Tungsten Powder Market

1. Optimizing Manufacturing Processes

AI-driven automation enhances the production of spherical tungsten powder by improving precision in particle size control, reducing material waste, and increasing overall efficiency. Machine learning algorithms analyze production parameters in real time, ensuring consistency and higher-quality output.

2. Enhancing Quality Control

AI-powered quality control systems utilize advanced imaging and pattern recognition to detect inconsistencies in spherical tungsten powder. These systems help manufacturers identify defects early, minimizing waste and improving product reliability for high-performance applications like aerospace and electronics.

3. Accelerating Research and Development

AI accelerates the development of advanced tungsten powder formulations by simulating different production methods and predicting material properties. This enables faster innovation in applications such as additive manufacturing, thermal spraying, and high-tech coatings.

4. Predictive Maintenance for Equipment

AI-driven predictive analytics helps in maintaining production equipment by forecasting potential failures and scheduling maintenance before breakdowns occur. This minimizes downtime and enhances operational efficiency in tungsten powder production facilities.

5. Improving Supply Chain and Inventory Management

AI optimizes supply chain management by predicting demand patterns and adjusting inventory levels accordingly. Smart logistics systems powered by AI reduce procurement costs and ensure a steady supply of raw materials, improving overall market efficiency.

6. Enhancing 3D Printing Capabilities

Spherical tungsten powder is widely used in 3D printing applications, and AI-powered optimization software enhances the printing process by adjusting parameters for better precision, reduced defects, and improved material utilization. AI-driven simulations enable manufacturers to test different powder compositions before actual production.

7. Strengthening Market Analysis and Decision-Making

AI-powered analytics tools help companies in the tungsten powder market analyze market trends, customer demands, and competitor strategies. These insights enable businesses to make data-driven decisions regarding pricing, expansion, and new product development.

8. Reducing Environmental Impact

AI facilitates sustainable manufacturing by optimizing energy consumption and reducing emissions in tungsten powder production. AI-based simulations help in identifying environmentally friendly production methods while maintaining cost-effectiveness.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 580.09 Million |

| Market Size in 2025 | USD 354.93 Million |

| Market Size in 2024 | USD 336.08 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.61% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Particle Size, Application, End-User Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

One of the primary drivers of market growth is the expanding adoption of 3D printing technologies, where spherical tungsten powder is used for producing intricate, high-strength components. Additionally, its usage in the aerospace industry for manufacturing engine components and thermal protection systems is driving demand. The growing need for radiation shielding materials in medical and nuclear applications also contributes to the market’s expansion.

Market Opportunities

The increasing emphasis on sustainability and recycling in the metal industry is opening new opportunities for tungsten powder manufacturers. Research into developing more cost-effective and environmentally friendly production processes is expected to drive future growth. The integration of artificial intelligence in powder manufacturing and quality control presents another significant opportunity for improving efficiency and reducing production costs.

Market Challenges

The market faces challenges related to the high cost of raw materials and the energy-intensive nature of tungsten powder production. Additionally, geopolitical factors affecting tungsten supply chains can lead to price fluctuations and availability issues. Strict quality standards and the need for precise powder specifications further add to manufacturing complexities.

Regional Insights

Asia Pacific leads the global spherical tungsten powder market due to its strong manufacturing base and significant tungsten reserves. North America is anticipated to grow at a substantial rate, driven by advancements in aerospace and defense applications. Europe is also expanding steadily, with a focus on research and innovation in tungsten-based materials for industrial applications.

Top 5 Tungsten-p Producing Countries in 2024

| Country | Tungsten production |

| China | 67,000 metric tons |

| Vietnam | 3,400 metric tons |

| Russia | 2,000 metric tons |

| North Korea | 1,700 metric tons |

| Bolivia | 1,600 metric tons |

Spherical Tungsten Powder Market Companies

- H.C. Starck GmbH

- Global Tungsten & Powders Corp.

- Buffalo Tungsten Inc.

- Kennametal Inc.

- Tungsten Heavy Powder & Parts

- Elmet Technologies

- Wolfram Company JSC

- Treibacher Industrie AG

- Tejing Tungsten Co., Ltd.

- Chinatungsten Online (Xiamen) Manu. & Sales Corp.

- Xiamen Tungsten Co., Ltd.

- Japan New Metals Co., Ltd.

- ALMT Corp.

- Beijing Tungsten & Molybdenum Group Co., Ltd.

- Ganzhou Grand Sea W & Mo Group Co., Ltd.

Latest Announcement by Market Leaders

- In October 2023, Sweden’s Sandvik AB announced it is to acquire Buffalo Tungsten, Inc. (BTI), a manufacturer of tungsten metal powder and tungsten carbide powder headquartered in Depew, New York, U.S. The acquisition of BTI is set to expand Sandvik’s presence in the North American market and strengthen its regional capabilities in the component manufacturing value chain.

- In September 2024, Kennametal Inc. announced the expansion of its comprehensive product line of tooling and wear protection solutions for mining applications. The new additions include picks to meet diverse customer demands as well as an innovative round drill steel system designed to improve efficiency and safety.PrimePoint™ features a polycrystalline diamond (PCD) tip, enabling longwall operators to mine longer.

Recent Developments

- In March 2024, Golden Metal Resources plc, a mineral exploration and development company focused on tungsten, gold, copper, lithium, and silver within Nevada, U.S., announced an exploration update on the 100% owned Pilot Mountain project (“Pilot Mountain” or the “Project”).

- In April 2023, Masan High-Tech Materials Corporation (MHT) and EQ Resources Limited (EQR) signed an MOU to work together in tungsten exploration, mining, assessing new project opportunities, and new product applications.

- In March 2023, The European Commission announced that it would be investing EUR 10 million in a research project to develop new applications for tungsten carbide. The project is expected to lead to the development of new tungsten carbide products that are more sustainable and have a lower environmental impact.

- In April 2023, China, the world’s largest producer of tungsten carbide, announced that it would be increasing its production of tungsten carbide by 5% in 2023. This increase is expected to meet the growing demand for tungsten carbide products in China and around the world.

Segments Covered in the Report

By Particle Size

- Fine

- Coarse

By Application

- 3D Printing

- Thermal Spraying

- Electronics

- Medical

- Others

By End-User Industry

- Aerospace

- Automotive

- Electronics

- Healthcare

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

Also Read: Cooling Fabrics Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/