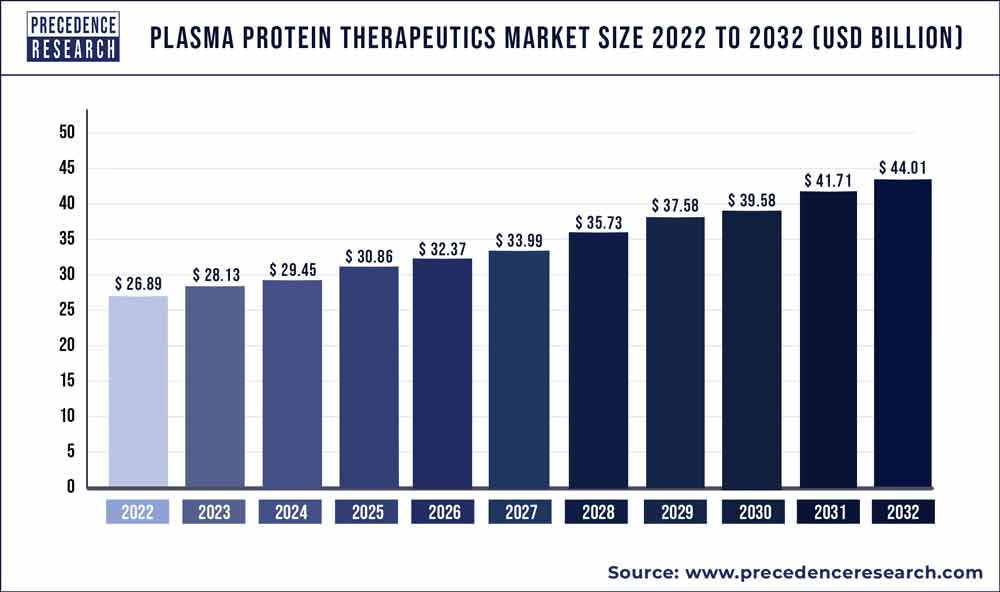

Plasma Protein Therapeutics Market Size To Worth USD 44.01 Bn By 2032

The global plasma protein therapeutics market size Surpassed USD 28.13 billion in 2023 and is projected to reach around USD 44.01 billion by 2032, growing at a CAGR of 5.10% from 2023 to 2032.

Key Takeaways

- North America contributed more than 47% of revenue share in 2022.

- Asia-Pacific is estimated to expand the fastest CAGR between 2023 and 2032.

- By product type, the immunoglobulin segment has held the largest market share of 35% in 2022.

- By product type, the albumin segment is anticipated to grow at a remarkable CAGR of 6.5% between 2023 and 2032.

- By application, the hemophilia segment generated over 32% of revenue share in 2022.

- By application, the primary immunodeficiency disorder segment is expected to expand at the fastest CAGR over the projected period.

- By end user, the hospitals segment generated over 70% of revenue share in 2022.

- By end user, the other segment is expected to expand at the fastest CAGR over the projected period.

The Plasma Protein Therapeutics Market encompasses a dynamic sector within the pharmaceutical industry dedicated to the development and production of therapeutic products derived from human plasma. These products include immunoglobulins, clotting factors, and albumin, among others. The market plays a crucial role in addressing various medical conditions, ranging from autoimmune disorders to hemophilia, making it an essential component of the global healthcare landscape.

Get a Sample: https://www.precedenceresearch.com/sample/3630

Plasma Protein Therapeutics Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 5.10% |

| Market Size in 2023 | USD 28.13 Billion |

| Market Size by 2032 | USD 44.01 Billion |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Product Type, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growth Factors:

Several key factors contribute to the growth of the Plasma Protein Therapeutics Market. The increasing prevalence of chronic diseases, rising geriatric population, and advancements in biotechnology have fueled the demand for plasma-derived therapies. Additionally, the expanding awareness of these therapies and their effectiveness in treating rare diseases has stimulated market growth. Collaborations between pharmaceutical companies for research and development, as well as improvements in plasma collection and purification techniques, further drive the market’s expansion.

Opportunities:

The Plasma Protein Therapeutics Market presents promising opportunities for stakeholders. The growing demand for novel therapies, especially in emerging markets, offers a significant avenue for expansion. Technological innovations, such as the development of recombinant plasma proteins and gene therapies, present exciting possibilities for the industry. Moreover, increased investment in research and development, coupled with regulatory support for faster approvals of plasma-derived products, creates a favorable environment for market players to explore new therapeutic avenues.

Challenges:

Despite its growth, the Plasma Protein Therapeutics Market faces challenges that warrant attention. Supply chain complexities, including the dependence on human plasma donors and the stringent regulatory requirements for product safety, pose challenges for market players. Economic fluctuations and high manufacturing costs also contribute to the industry’s volatility. Moreover, ethical concerns related to plasma collection and potential adverse effects of plasma-derived therapies may impact public perception, emphasizing the need for effective communication strategies within the industry.

By Product Type:

Immunoglobulins (IG): Immunoglobulins, or antibodies, constitute a significant product type within the market. They find applications in treating immunodeficiency disorders, autoimmune diseases, and infections. The increasing incidence of immunological disorders has propelled the demand for immunoglobulin-based therapies, making this segment a vital contributor to the market’s expansion.

Clotting Factor Concentrates: This product type is crucial for individuals with bleeding disorders, especially hemophilia. Derived from plasma, clotting factor concentrates play a pivotal role in managing and preventing bleeding episodes. Advances in clotting factor therapies and a growing awareness of bleeding disorders have led to substantial growth in this market segment.

Albumin: Albumin, a versatile plasma protein, is utilized in various medical applications. It is employed for fluid volume restoration, therapeutic plasma exchange, and as a drug carrier. The demand for albumin-based therapies is influenced by factors such as the rising prevalence of liver diseases and an aging population.

Protease Inhibitors and Alpha-1 Antitrypsin: Protease inhibitors are used in treating conditions like HIV/AIDS, while alpha-1 antitrypsin is employed in managing genetic disorders affecting the lungs and liver. These product types address specific medical needs, contributing to the diverse spectrum of therapies available in the market.

By Application:

Hematology: Applications in hematology primarily involve clotting factor concentrates for the treatment of bleeding disorders. This segment plays a crucial role in addressing the medical needs of patients with conditions such as hemophilia.

Neurology: Immunoglobulins are extensively used in neurology applications to treat disorders affecting the nervous system. The neurology segment contributes significantly to the market’s growth due to the increasing prevalence of neurological conditions.

Immunology: Immunoglobulins, as well as protease inhibitors, are key components in addressing immunological disorders and infectious diseases. The immunology segment is pivotal in providing therapeutic solutions for a range of immune-related conditions.

By End-user:

Hospitals: Hospitals represent a major end-user of plasma protein therapeutics. The diverse range of applications and treatments offered in hospital settings underscores their significance in the overall market.

Clinics: Clinics, including specialty and outpatient clinics, are important end-users, particularly for ongoing treatments and management of chronic conditions requiring plasma protein therapies.

Homecare Settings: The trend towards home-based healthcare has led to an increased adoption of plasma protein therapies in homecare settings. Patients with certain conditions can receive treatments in the comfort of their homes, contributing to the market’s accessibility and patient-centric care.

Read Also: Radar Sensors Market Size to Garner USD 39.37 Billion by 2032

Recent Developments

- In December 2022, Biotest AG revealed the initiation of a clinical phase II pilot study for treating chronic hepatitis B with hyperimmunoglobulins at the Hanover Medical School, enrolling the first of 20 patients.

- In June 2022, Biotest AG reported a successful interim analysis of the phase III AdFIrst trial, assessing Fibrinogen in patients with acquired fibrinogen deficiency.

- In May 2020, Biotest AG completed the clinical trial 984, treating patients with congenital fibrinogen deficiency using the fibrinogen concentrate (BT524) for acute bleeding or prophylactic treatment before surgery.

- In July 2022, Takeda announced the positive outcome of the ADVANCE-1 Phase 3 clinical trial for HYQVIA in the maintenance treatment of chronic inflammatory demyelinating polyradiculoneuropathy (CIDP).

- In November 2022, Biotest AG received approval from the Paul-Ehrlich-Institute for the new intravenous immunoglobulin Yimmugo (IgG Next Generation) in Germany.

- In January 2022, Bio Products Laboratory (BPL) obtained a license from the NMPA to market ALBUMINEX 25% product in China.

- In March 2022, Grifols announced the approval of XEMBIFY, its 20% subcutaneous immunoglobulin, by several European Union member state health authorities and the U.K., to treat primary and select secondary immunodeficiency.

- In April 2022, Grifols completed the acquisition of Tiancheng (Germany) Pharmaceutical Holdings AG, which holds a significant stake in Biotest AG.

- In September 2022, Grifols signed a long-term agreement with Canadian Blood Services to enhance Canada’s self-sufficiency in immunoglobulin medicines.

Plasma Protein Therapeutics Market Players

- CSL Limited

- Grifols S.A.

- Takeda Pharmaceutical Company Limited

- Octapharma AG

- Biotest AG

- Kedrion S.p.A.

- Shire (acquired by Takeda)

- Bio Products Laboratory (BPL)

- Kamada Ltd.

- China Biologic Products Holdings, Inc.

- Octapharma Plasma, Inc.

- Sanquin

- LFB S.A.

- ADMA Biologics, Inc.

- Bioverativ (acquired by Sanofi)

Segments Covered in the Report

By Product Type

- Immunoglobulin

- Albumin

- Plasma derived factor VIII

- Others

By Application

- Hemophilia

- Idiopathic thrombocytopenic purpura

- Primary immunodeficiency disorder

- Others

By End-user

- Hospitals

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/