Emergency Department Information System Market Size, Share Report 2032

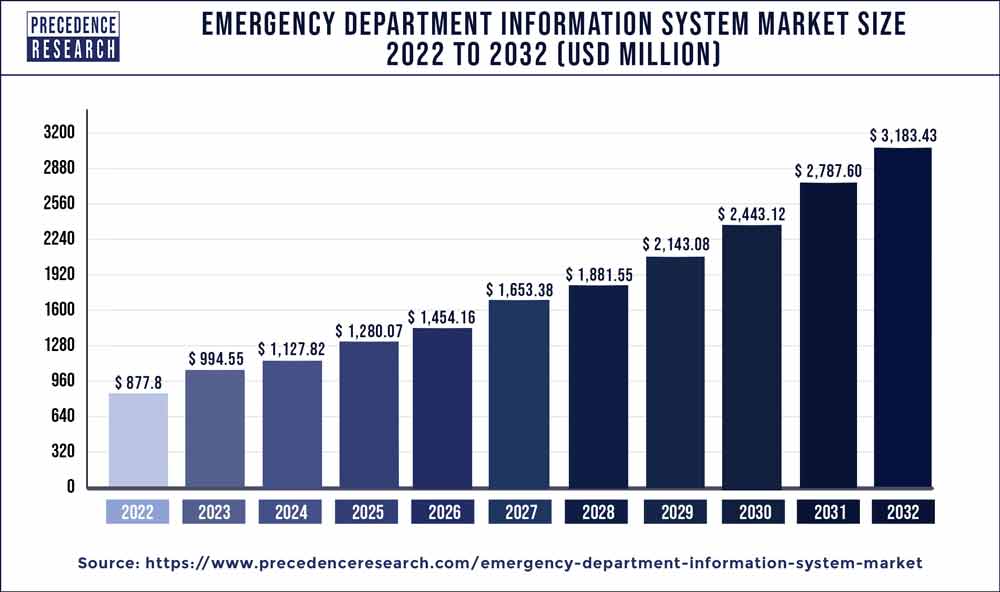

The global emergency department information system market size is projected to hit around USD 3,183.43 billion by 2032 from USD 994.55 billion in 2023, at a CAGR of 13.80% from 2023 to 2032.

Key Takeaways

- Asia Pacific is expected to witness the fastest rate of growth in the emergency department information system market during the forecast period.

- By software type, the best of breed (B.O.B.) solutions segment is expected to hold the dominating share of the market during the forecast period.

- By software type, the enterprise solutions segment is expected to grow at a notable rate.

- By application, the computerized physician order entry (CPOE) segment held the largest segment of the emergency department information system market in 2022.

- By application, the E-prescribing segment is expected to grow at a significant rate during the forecast period.

- By deployment, the software-as-a-services (SaaS) segment is expected to hold the dominating share of the market during the forecast period.

- By deployment, the on-premises emergency department information system segment is expected to grow at a notable rate.

The Emergency Department Information System (EDIS) market has witnessed substantial growth in recent years, driven by the increasing demand for efficient and streamlined healthcare operations. EDIS plays a crucial role in enhancing emergency care by providing a comprehensive solution that integrates patient data, automates workflows, and improves communication among healthcare professionals. As hospitals and healthcare facilities worldwide continue to prioritize efficient emergency services, the EDIS market has become a cornerstone in achieving optimal patient outcomes and operational efficiency.

Growth Factors

Several factors contribute to the robust growth of the Emergency Department Information System market. Firstly, the rising prevalence of medical emergencies and the subsequent need for swift and accurate information management propel the adoption of EDIS. Additionally, the integration of advanced technologies, such as artificial intelligence and real-time analytics, within these systems further augments their capabilities. The ongoing digital transformation in the healthcare sector, coupled with a focus on improving patient experience and outcomes, acts as a significant catalyst for the sustained growth of the EDIS market.

Get a Sample: https://www.precedenceresearch.com/sample/3661

Region Snapshot

The market for Emergency Department Information Systems exhibits a global presence, with notable growth observed across various regions. North America, particularly the United States, holds a substantial market share, driven by the advanced healthcare infrastructure and early adoption of technology. Europe follows suit, benefitting from progressive healthcare policies and increasing investments in digital healthcare solutions. Moreover, the Asia-Pacific region is emerging as a key player, with developing economies embracing EDIS to strengthen their healthcare systems and address the growing demand for emergency care services.

Competitive Landscape:

The competitive landscape of the Emergency Department Information System market is characterized by a mix of established players and innovative startups striving to offer cutting-edge solutions. Leading companies in the sector focus on strategic collaborations, mergers, and acquisitions to expand their product portfolios and strengthen their market presence. Notable players are investing in research and development to stay ahead in technological advancements, ensuring that their EDIS offerings align with the evolving needs of healthcare providers. The competition is intense, fostering continuous innovation and driving the overall growth and maturity of the Emergency Department Information System market.

Emergency Department Information System Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 13.80% |

| Market Size in 2023 | USD 994.55 Billion |

| Market Size by 2032 | USD 3183.43 Billion |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Software Type, By Application, and By Deployment |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Software Type:

Documentation Software: Documentation software within EDIS focuses on efficiently capturing and managing patient information. It includes electronic health record (EHR) modules designed to record and organize critical patient data, such as medical history, vital signs, medications, and diagnostic results. This ensures accurate and accessible information for healthcare professionals involved in emergency care.

Tracking and Triage Software: This software type is dedicated to real-time tracking and triage functionalities. It helps emergency department staff monitor patient flow, prioritize cases based on severity, and optimize resource allocation. Tracking and triage software contributes to reducing wait times, improving patient outcomes, and enhancing overall department efficiency.

Analytics and Reporting Software: Analytics and reporting software in EDIS enable healthcare administrators to derive insights from data collected within the emergency department. These tools provide valuable information on patient demographics, trends, and performance metrics. The analytics component supports evidence-based decision-making, quality improvement initiatives, and resource planning.

Communication and Collaboration Software: Effective communication is crucial in emergency settings. This software type focuses on facilitating communication and collaboration among healthcare professionals. It may include features like secure messaging, task assignment, and notification systems to ensure timely and coordinated responses to emergency cases.

Application:

Patient Management: EDIS applications for patient management encompass functionalities related to patient registration, triage, and tracking throughout their emergency department journey. This ensures a seamless and organized process for handling incoming patients, optimizing resource utilization, and providing timely care.

Clinical Workflow Optimization: Applications under this category focus on streamlining clinical workflows within the emergency department. They may include features for order entry, decision support, and task automation, aiming to enhance the efficiency of healthcare professionals in diagnosing and treating patients in emergency situations.

Resource Allocation and Bed Management: These applications are designed to optimize the allocation of resources, including personnel and bed space, within the emergency department. Real-time tracking and reporting functionalities assist in managing patient flow, minimizing bottlenecks, and ensuring that resources are allocated based on the urgency and severity of cases.

Deployment

On-Premises Deployment: Some healthcare institutions prefer on-premises deployment, where the EDIS software is installed and operated on servers within the organization’s physical premises. This option provides a high level of control over the system and data but requires dedicated IT infrastructure and maintenance.

Cloud-Based Deployment: Cloud-based deployment involves hosting the EDIS software on external servers managed by third-party providers. This option offers scalability, flexibility, and often reduces the burden of infrastructure management on healthcare organizations. Cloud-based solutions enable remote access to the system, fostering collaboration and data accessibility from different locations.

Hybrid Deployment: Hybrid deployment combines elements of both on-premises and cloud-based solutions. This approach allows healthcare organizations to leverage the benefits of both deployment models, tailoring the system to their specific needs. It can be particularly useful for organizations with specific security or compliance requirements.

Read Also: Cloud Infrastructure Market Size To Record USD 653.88 Bn By 2032

Recent Developments

In March 2022, HeartBeam, Inc. made significant strides by announcing a Business Associate Contract and Clinical Trial Arrangement (CTA) with Phoebe Putney Healthcare System. This partnership aims to conduct a trial assessing the effectiveness of HeartBeam’s ED Myocardial Infarction (MI) technology solution. By engaging in this clinical trial, HeartBeam seeks to validate and refine its innovative solution for detecting and managing myocardial infarctions in emergency department settings.

In January 2022, Aidoc and Novant Health forged a strategic collaboration with a focus on improving patient satisfaction and reducing emergency room stays. Novant Health’s proactive approach involves leveraging Aidoc’s advanced AI system, equipped with seven FDA-cleared techniques for rapid evaluation and notification of individuals with severe illnesses. This alliance underscores the commitment to utilizing cutting-edge technology to enhance emergency healthcare processes, streamline patient care, and ultimately improve outcomes within the healthcare system.

Emergency Department Information System Market Companies

- McKesson Corporation

- Cerner Corporation

- Epic Systems Corporation

- Allscripts Healthcare Solutions, Inc.

- Siemens Healthineers AG

- Philips Healthcare

- T-System, Inc.

- EPOWERdoc

- Wellsoft Corporation

- Softek Illuminate

- EDM Systems

- Optum (UnitedHealth Group)

- Athenahealth, Inc.

- TriTech Software Systems

- Infor

Segments Covered in the Report

By Software Type

- Enterprise Solutions

- Best of Breed (B.O.B.) Solutions

By Application

- Computerized Physician Order Entry (CPOE)

- Clinical Documentation

- Patient Tracking & Triage

- E-Prescribing

- Others

By Deployment

- On-Premises

- Software-As-A-Services (SaaS)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/