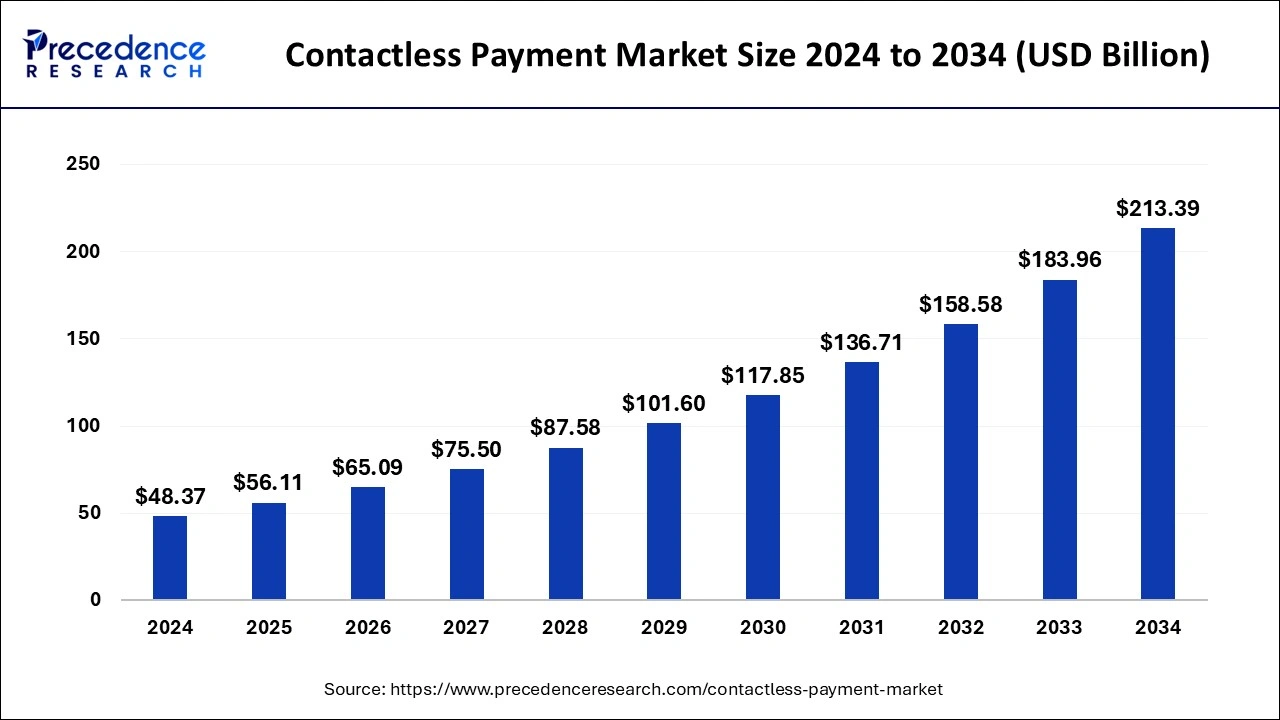

Contactless Payment Market Size to Attain USD 213.39 Billion by 2034

Contactless Payment Market Size and Growth

The contactless payment market size was accounted at USD 48.37 billion in 2024 and is anticipated to attain around USD 213.39 billion by 2034 with a CAGR of 16%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1044

Key Takeaways

- In 2024, North America held the largest share of the global market.

- The payment terminal solution category contributed more than 40% of the overall revenue.

- The retail application segment secured over 60% of the revenue share.

- The smartphones and wearables category generated more than 60% of the revenue share.

AI’s Growing Influence on Contactless Payment Innovation

- AI automates risk assessment, ensuring secure and seamless transactions.

- Voice and facial recognition powered by AI enhance authentication for contactless payments.

- Smart AI algorithms analyze spending patterns to offer personalized financial insights.

Contactless Payment Market Overview

The contactless payment market has evolved as a key component of the global digital economy. With advancements in NFC, QR codes, and mobile payment technologies, contactless transactions have become an essential part of everyday commerce. The demand for seamless, fast, and secure transactions has led businesses and consumers to shift away from traditional cash-based payments. As more businesses adopt digital payment methods, the reliance on physical currency continues to decline, creating a more connected and efficient payment ecosystem.

Market Dynamics

Market Drivers

One of the primary factors driving market growth is the increasing adoption of mobile payments and digital wallets. Consumers prefer contactless transactions due to their speed and ease of use, making them an ideal solution for in-store, online, and transit payments. Financial institutions and fintech companies are investing heavily in improving security features such as tokenization and biometric authentication to enhance user trust. Additionally, businesses are leveraging data analytics and artificial intelligence to offer personalized payment experiences, further driving market expansion.

Opportunities

The integration of contactless payments in everyday transactions such as parking, vending machines, and public transport offers immense growth opportunities. As smart city initiatives continue to expand, digital payments will play a crucial role in shaping urban mobility and commerce. The rise of embedded finance and buy-now-pay-later (BNPL) solutions also presents new revenue streams for financial service providers. Furthermore, the increasing number of partnerships between payment processors, merchants, and telecom companies is expected to accelerate innovation in the sector.

Challenges

Despite its widespread adoption, the market faces challenges related to fraud prevention, technological compatibility, and consumer trust. The risk of data breaches and identity theft poses a major concern for users and service providers. In some regions, the transition to contactless payments is hindered by outdated infrastructure and resistance from cash-reliant economies. The cost of upgrading payment terminals and ensuring compliance with evolving regulations also presents a challenge for merchants and financial institutions.

Regional Insights

North America and Europe remain the frontrunners in the contactless payment market, supported by strong digital payment ecosystems and high consumer acceptance. The Asia-Pacific region is experiencing rapid adoption, particularly in countries like China, India, and South Korea, where mobile payment apps dominate the market. Latin America and Africa, although still in the early stages, present vast growth potential as governments and businesses work toward increasing digital payment adoption. With continuous advancements in payment technologies, all regions are expected to witness further growth in the coming years.

Contactless Payment Market Companies

- Verifone

- Ingenico Group SA

- Gemalto

- Visa Inc.

- Giesecke & Devrient GmbH

- Heartland Payment Systems, Inc.

- Thales Group

- Wirecard AG

- On Track Innovations Ltd.

- IDEMIA

Recent Developments:

- In August 2024, Mastercard collaborated with boAt, India’s leading wearables brand, to enable contactless payments on boAt’s payment-enabled smartwatches. This collaboration enables Mastercard cardholders to make convenient and secure transactions using the boat’s wearable devices by offering key features such as Tap-and-Pay functionality and enhanced security.

- In September 2024, NMI, a global leader in embedded payments, partnered with INIT, a leading supplier of public transit ticketing solutions, to implement a cutting-edge payment processing solution for the San Diego Metropolitan Transit System (MTS). This collaboration showcases a new “Tap-on/Tap-off” model that enhances both convenience and security for daily commuters on MTS buses and trolleys.

- In January 2025, Mollie, a leading provider of financial services in Europe, introduced Apple’s Tap to Pay on iPhone for its customers in Austria, Italy, and the U.K. This allows businesses of all sizes to use the Mollie app on iPhone to accept contactless payments without the need for additional hardware.

Segments Covered in the Report

By Solution

- Security and Fraud Management

- Payment Terminal Solution

- Transaction Management

- Hosted Point-of-Sales

- Analytics

By Application

- Government

- Healthcare

- Retail

- Transportation

- Hospitality

By Device

- Point-of-Sales Terminals

- Smartphones & Wearables

- Smart Cards

By Regional

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/