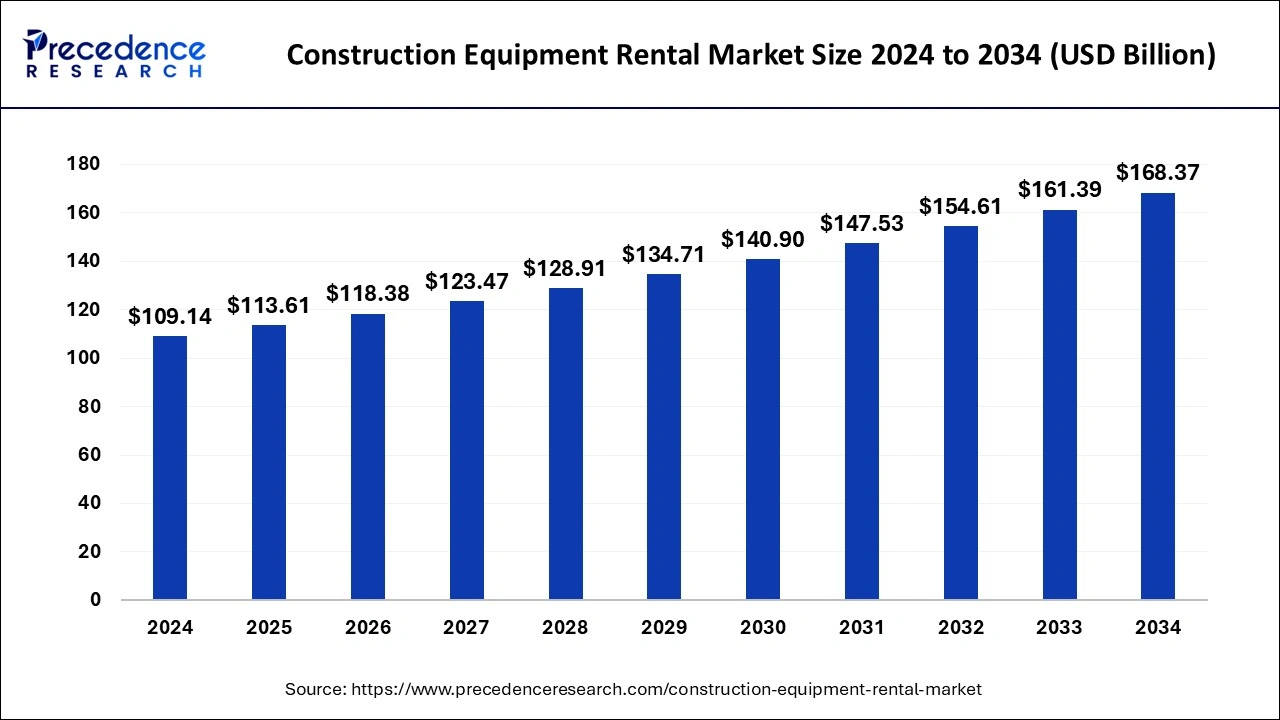

Construction Equipment Rental Market Size to Soar USD 168.37 Billion by 2034

The construction equipment rental market was calculated at USD 109.14 billion in 2024 and is projected to soar around USD 168.37 billion by 2034 with a CAGR of 4.43%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1078

Key Insights

- With a 31.64% market share, North America was the top-performing region in 2024.

- The region is expected to witness the highest CAGR during the forecast period (2024–2034).

- The earthmoving machinery segment held the largest share by product type in 2024.

Market Dynamics

Drivers

The growing need for cost-efficient and on-demand access to construction equipment is a major driver of the rental market. Renting allows construction firms to avoid large capital expenditures while maintaining access to modern machinery. The increasing number of government-funded infrastructure projects, including highways, railways, and smart city initiatives, is fueling demand for rental services. Additionally, rising labor costs and the need for efficient project execution are pushing construction companies toward renting automated and technologically advanced equipment.

Opportunities

The emergence of digital platforms and online rental marketplaces is transforming the construction equipment rental industry. Companies are now able to compare pricing, check equipment availability, and book machinery with ease, improving rental efficiency. The expansion of sustainable construction practices is also opening new opportunities for rental companies offering electric and low-emission equipment. Furthermore, developing economies with growing construction sectors, such as India, Brazil, and Indonesia, present significant market expansion potential.

Challenges

A key challenge in the market is the high cost of maintaining and upgrading rental equipment to meet evolving industry standards. Equipment depreciation, wear and tear, and the need for regular inspections add to operational costs. Additionally, fluctuating fuel prices and raw material shortages can impact the availability and affordability of construction equipment rentals. The presence of unorganized rental providers in developing markets also leads to inconsistent service quality and pricing competition.

Regional Outlook

Construction Equipment Rental Market Companies

- JCB

- Zahid Group

- Industrial Supplies Development Co. Ltd

- Ahern Equipment Rentals

- John Deere

- Caterpillar Inc.

- Gemini Equipment and Rentals (GEAR)

- Hertz Equipment

- Komatsu Equipment

- Maxim Crane Works

- Neff Rental

Recent Development

- In October 2023, Komatsu is prepared to introduce new electric excavators in the 20-ton class. Additionally, Komatsu intends to progressively launch these electric models in Australia, Asia, and North America. As part of its goal to become carbon neutral by 2050, Komatsu sees this new model’s release as a chance to jumpstart the market for electric construction equipment.

- In February 2024, Case Introduces New Machines and Hip-Pocket Support to Advance Rental Businesses. Case will display its most recent models and product lines, which include tiny articulated loaders, micro track loaders, backhoe loaders, and more. Along with a variety of innovative attachments, equipment such as the Utility Plus backhoe loader, which has won numerous awards, will be showcased for the rental market.

Segments Covered in the Report

By Product

- Material Handling Machinery

- Shelves

- Bins

- Silos

- Conveyors

- Pallet trucks

- Fork lifts

- Frames

- Sliding racks

- Bulk containers

- Platform trucks

- Hand trucks

- Cranes

- Others

- Earth Moving Machinery Concrete

- Excavators

- Loading shovels

- Site dumpers

- Dump trucks

- Others

- Concrete and Road Construction Machinery

- Pavers

- Trenchers

- Planers

- Rollers

- Hot boxes

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/