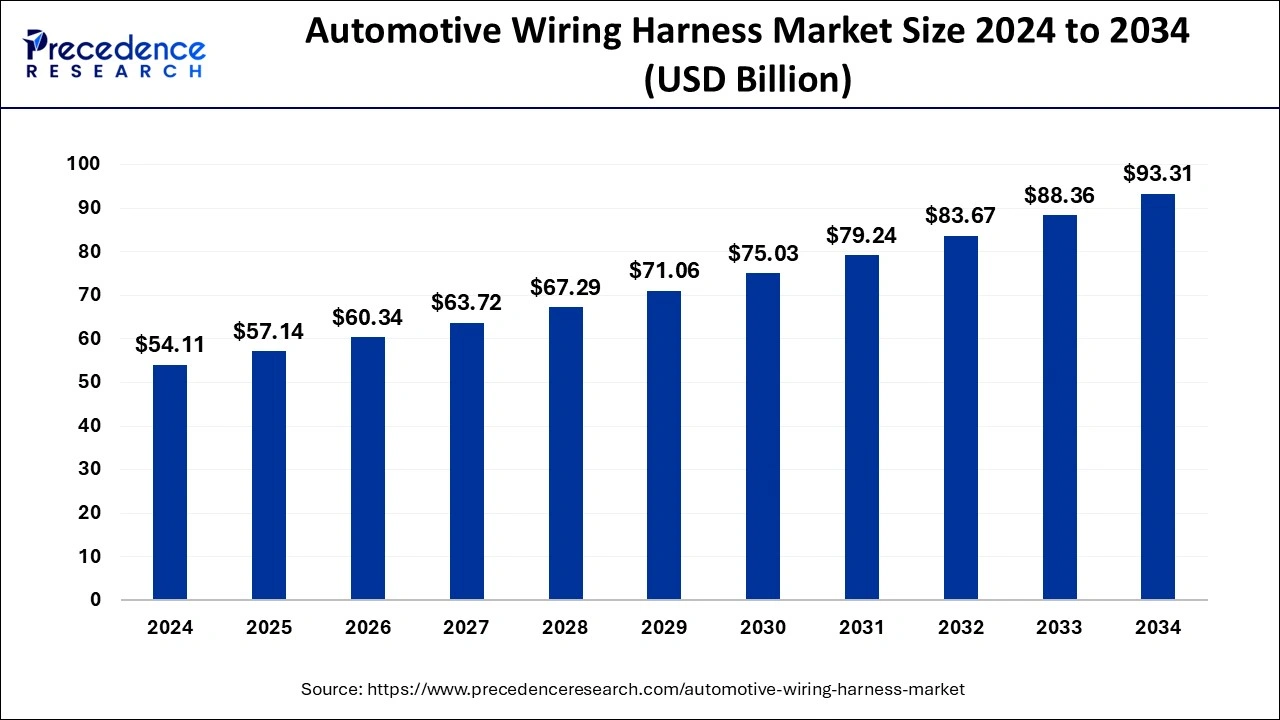

Automotive Wiring Harness Market to Hit $93.31 Billion by 2034

The automotive wiring harness market is set to reach USD 93.31 billion by 2034, up from USD 54.11 billion in 2024, driven by a steady CAGR of 5.60%

Automotive Wiring Harness Market Key Takeaways

- With a 48% share, Asia Pacific was the top regional market for automotive wiring harnesses in 2024.

- The copper segment held the highest share of 65% in the material category.

- ICE vehicles continued to dominate propulsion, accounting for 82% of the market in 2024.

- Passenger cars represented a significant portion, contributing 58% of the total market share.

- The low-voltage segment remained the largest, capturing 85% of the market in 2024.

Automotive Wiring Harness Market Overview

The automotive wiring harness market is experiencing steady growth, driven by advancements in vehicle technology, increasing vehicle production, and the rising demand for electric and hybrid vehicles. A wiring harness is a crucial component in modern automobiles, serving as a network of wires, connectors, and terminals that transmit electrical signals and power to various vehicle systems. It ensures seamless communication between different electronic components, enhancing vehicle performance, safety, and efficiency. As vehicles become more advanced with features such as infotainment systems, advanced driver assistance systems (ADAS), and electric powertrains, the demand for sophisticated and lightweight wiring harness solutions continues to grow.

Market Drivers

Several key factors are driving the expansion of the automotive wiring harness market. The increasing adoption of electric and hybrid vehicles has significantly contributed to the demand for high-voltage wiring harnesses, as these vehicles require advanced electrical architectures to manage energy distribution efficiently. Additionally, the growing implementation of safety and convenience features, such as adaptive cruise control, lane departure warning, and smart infotainment systems, necessitates complex wiring solutions. Stricter government regulations regarding vehicle safety and emissions are also pushing manufacturers to develop innovative wiring harnesses that support energy-efficient systems. Moreover, the rising trend of vehicle electrification, coupled with automation and connectivity, is further boosting the market’s growth.

Opportunities in the Market

The automotive wiring harness market presents several promising opportunities for growth and innovation. One major opportunity lies in the development of lightweight and high-performance wiring harnesses that improve fuel efficiency and reduce vehicle weight. The growing emphasis on autonomous driving and connected car technologies is also creating demand for advanced wiring solutions capable of handling higher data transmission rates. Furthermore, the expansion of the automotive industry in emerging markets presents a lucrative opportunity for manufacturers to establish production facilities and cater to increasing vehicle demand. Another area of opportunity is the integration of smart materials, such as fiber optics and aluminum wiring, to enhance durability and efficiency in wiring systems.

Challenges Facing the Market

Despite the promising growth prospects, the automotive wiring harness market faces several challenges. One of the major challenges is the complexity of modern vehicle electrical systems, which require extensive wiring networks, increasing the risk of faults and maintenance costs. Additionally, fluctuations in raw material prices, particularly copper and aluminum, can impact production costs and profitability for manufacturers. The growing shift toward wireless connectivity in vehicles also poses a potential challenge, as it may reduce the reliance on traditional wiring harnesses in the long run. Another key challenge is ensuring compliance with varying safety and quality standards across different regions, which can complicate product development and regulatory approvals.

Regional Insights

The automotive wiring harness market is expanding across various regions, with some areas experiencing more rapid growth than others. North America and Europe lead the market due to their strong automotive industries, technological advancements, and stringent safety regulations. The Asia-Pacific region is witnessing the fastest growth, driven by increasing vehicle production, rising disposable incomes, and expanding manufacturing capabilities in countries such as China, India, and Japan. Latin America, the Middle East, and Africa are also showing gradual growth, with increasing investments in automotive infrastructure and demand for passenger and commercial vehicles. The overall market growth is influenced by regional factors such as government policies, economic conditions, and advancements in automotive technology.

Recent Developments

The automotive wiring harness industry has witnessed significant advancements in recent months. Automakers and suppliers are prioritizing the development of lightweight wiring solutions to improve vehicle efficiency and performance. Companies are also ramping up investments in high-voltage wiring harness production to meet the growing demand for electric vehicles. Additionally, emerging technologies such as flexible printed circuit boards and modular wiring systems are gaining momentum, offering enhanced efficiency and seamless integration into modern vehicles. With the increasing adoption of connected and autonomous vehicles, wiring harness manufacturers are collaborating with technology firms to create next-generation solutions that enable seamless vehicle communication and improved safety features.

The automotive wiring harness market is set for continued expansion, driven by technological advancements, the rising trend of vehicle electrification, and the incorporation of smart features. As manufacturers focus on enhancing efficiency, safety, and sustainability, the industry is expected to evolve with innovative materials, advanced designs, and cutting-edge technologies that optimize overall vehicle performance.

Automotive Wiring Harness Market Companies

- Sumitomo Electric Industries, Ltd.

- Delphi Automotive LLP

- Furukawa Electric Co. Ltd

- Lear Corporation

- THB Group

- Yura Corporation

- Leoni Ag

Segments Covered in the Report

By Type

- Engine Harness

- Dashboard/ Cabin Harness

- Battery Wiring Harness

- Chassis Wiring Harness

- Body & Lighting Harness

- HVAC Wiring Harness

- Seat Wiring Harness

- Door Wiring Harness

- Sunroof Wiring Harness

By Material

- Metallic

- Aluminum

- Copper

- Other Metals

- Optical Fiber

- Plastic Optical Fiber

- Glass Optical Fiber

By Propulsion

- IC Engine Vehicle

- Electric Vehicle

By Transmission

- Electric Wiring

- Data Transmission

- <150 Mbps

- 150 Mbps to 1 Gbp

- >1 Gbps

By Vehicle

- Commercial Vehicle

- Passenger Vehicle

By Voltage

- Low Voltage

- High Voltage

By Sales Channel

- OEM

- Aftermarket

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/