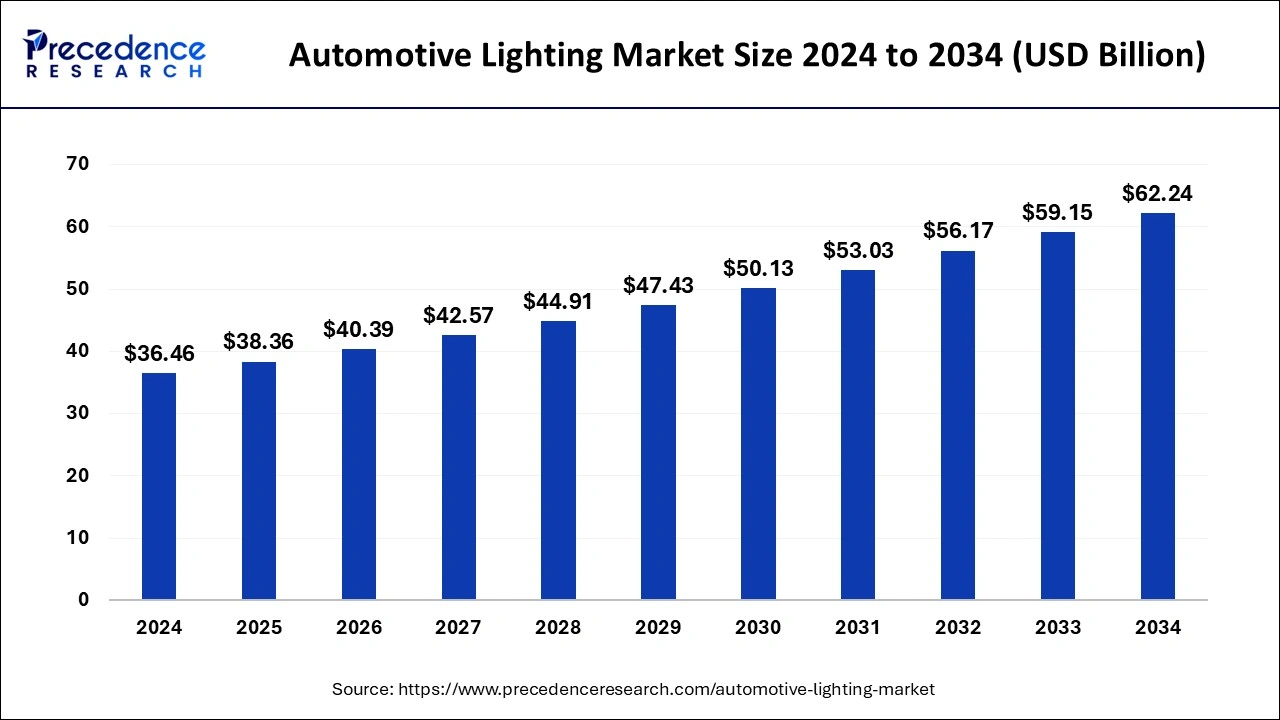

Automotive Lighting Market Size to Surpass USD 62.24 Bn by 2034

Automotive Lighting Market

The global automotive lighting market size is expected to surpass around USD 62.24 billion by 2034 increasing from USD 36.46 billion in 2024, with a CAGR of 5.49%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1079

Key Insights

- Asia Pacific led the global market with a dominant share of 40.11% in 2024.

- By technology, halogen lighting held the maximum market share in 2024.

- The LED technology segment is set to grow at the highest CAGR over the forecast period.

- The front/headlamps segment is poised for the fastest expansion over the projected timeframe.

Market Dynamics

Drivers

The rising demand for energy-efficient and high-performance vehicle lighting solutions is a key driver of the automotive lighting market. LED technology is replacing conventional halogen and xenon lighting due to its longer lifespan and lower power consumption. The increasing production of electric and hybrid vehicles is further fueling the adoption of smart lighting systems. Additionally, advancements in vehicle automation and connectivity are promoting the use of adaptive and sensor-based lighting solutions to improve safety and comfort.

Opportunities

The growing focus on vehicle personalization and aesthetics is opening up new opportunities in the automotive lighting industry. Automakers are incorporating advanced lighting designs, such as dynamic turn signals, programmable ambient lighting, and customizable headlamps, to enhance the driving experience. The integration of artificial intelligence (AI) and augmented reality (AR) into vehicle lighting is also gaining traction, creating opportunities for innovation. Furthermore, the expansion of ride-sharing and electric mobility services is driving demand for durable and intelligent lighting solutions.

Challenges

Market growth is hindered by the high cost of developing and implementing next-generation lighting technologies. OLED and laser lighting, while offering superior performance, remain expensive and are primarily limited to luxury and high-end vehicles. The ongoing semiconductor shortage and supply chain disruptions are also causing delays in lighting component production. Additionally, the lack of uniform regulations across different regions can create compliance challenges for manufacturers looking to expand globally.