Automotive Door Handles Market Size to Achieve USD 7.40 Billion by 2034

Automotive Door Handles Market Size and Growth

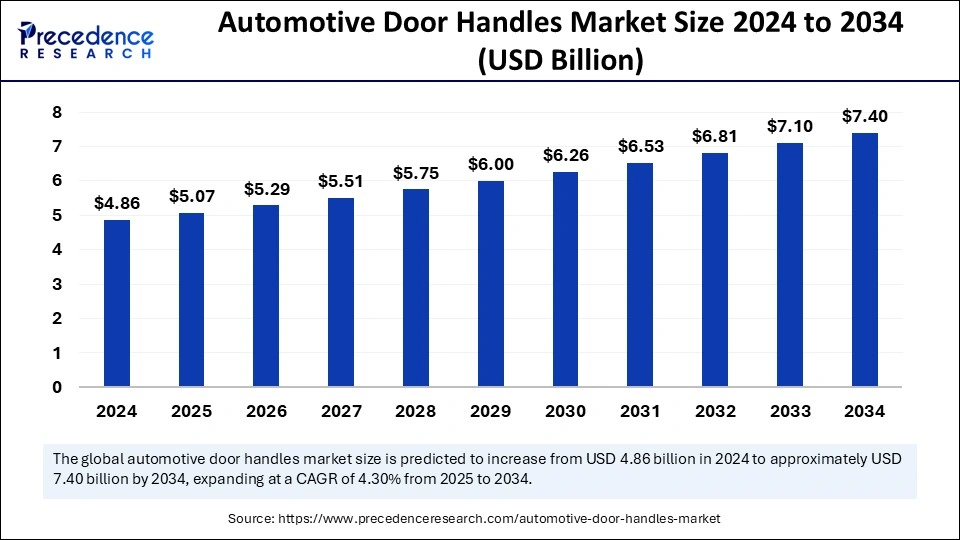

The global automotive door handles market size was evaluated at USD 4.86 billion in 2024 and is expected to achieve around USD 7.40 billion by 2034, growing at a CAGR of 4.30%.

Get the Sample Copy of Report@ https://www.precedenceresearch.com/sample/5730

Key Points

-

Asia Pacific led the automotive door handles market in 2024, holding the highest market share.

-

North America is projected to experience strong growth with a notable CAGR during the forecast period.

-

The exterior door handles segment dominated the market by type in 2024.

-

The interior door handles segment is expected to expand at the fastest CAGR in the coming years.

-

The passenger vehicle segment secured the largest market share by vehicle type in 2024.

-

The commercial vehicles segment is forecasted to witness the most rapid growth over the projection period.

-

The mechanical handle segment held the highest market share in 2024 by handle type.

-

The automatic handle segment is anticipated to grow at the fastest rate during the forecast period.

-

The original equipment manufacturer (OEM) segment was the leading sales channel in 2024.

-

The aftermarket segment is estimated to expand at the highest CAGR in the upcoming years.

Role of AI in the Automotive Door Handles Market

-

Smart and Keyless Entry Systems

AI is transforming automotive door handles by enabling keyless and biometric entry solutions. Facial recognition, fingerprint scanning, and voice authentication allow secure, seamless access to vehicles without the need for traditional keys. These advancements enhance security while improving user convenience. -

Predictive Maintenance and Fault Detection

AI-driven analytics monitor smart door handles, identifying issues such as sensor malfunctions or component wear. By analyzing usage patterns and environmental conditions, AI can predict maintenance needs, preventing unexpected failures and reducing repair costs. -

Gesture and Proximity-Based Access

AI integrates with motion and proximity sensors to enable hands-free entry. Vehicles equipped with AI-powered door handles can detect authorized users based on movement patterns, automatically unlocking the doors as the user approaches. This feature enhances convenience, particularly in luxury and electric vehicles. -

Enhanced Security and Anti-Theft Features

AI strengthens vehicle security through multi-factor authentication for entry. By analyzing behavioral patterns, AI can detect unauthorized access attempts, triggering alerts or locking the vehicle. These advanced security measures reduce the risk of theft and unauthorized entry. -

Personalized User Experience

AI allows for a customized vehicle entry experience by recognizing individual drivers. Upon identification, AI can adjust seat positions, climate control, and infotainment settings, ensuring a personalized and seamless driving experience. -

Integration with Connected Car Systems

AI-powered door handles are integrated into the connected car ecosystem, enabling remote control via mobile apps and smart home devices. Users can lock and unlock doors, monitor access history, and receive security notifications through AI-driven platforms, enhancing convenience and safety. -

Energy Efficiency and Sustainability

AI optimizes power consumption in smart door handles, ensuring minimal energy use while maintaining high security. In electric vehicles, AI-powered handles contribute to overall energy efficiency by reducing unnecessary power drain, supporting sustainability efforts.

Automotive Door Handles Market Overview

The automotive door handles market is undergoing a transformation as the industry moves towards advanced, automated, and touchless access systems. The demand for hands-free and keyless entry solutions is increasing, especially in electric and high-end vehicles. With continuous R&D efforts, manufacturers are developing lightweight and sensor-enabled handles to enhance vehicle safety and convenience.

Market Drivers

Advancements in vehicle automation and AI-driven access systems are key drivers of the market. Automakers are investing in smart entry solutions to enhance security and user experience. Additionally, the growing popularity of electric vehicles is increasing the demand for innovative and energy-efficient door handles.

Market Opportunities

The rise of autonomous vehicles and AI-integrated access systems presents significant growth opportunities for the market. Biometric authentication, gesture-based controls, and voice recognition systems are expected to drive innovation in automotive door handles. The increasing preference for premium vehicle features in developing economies also provides new market avenues.

Market Challenges

High costs associated with smart and biometric door handles may limit their adoption in mid-range vehicles. The complexity of integrating electronic components while maintaining durability and reliability remains a challenge. Additionally, concerns over cybersecurity and unauthorized access require constant innovation in security protocols.

Regional Outlook

Asia Pacific continues to dominate the market, supported by the rapid expansion of the automotive sector and increasing vehicle sales. North America is expected to see notable growth due to the rising adoption of smart car technologies. Europe remains a key market, with a focus on vehicle security enhancements and regulatory compliance.

Also Read: Industrial Diesel Turbocharger Market

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 7.40 Billion |

| Market Size in 2025 | USD 5.07 Billion |

| Market Size in 2024 | USD 4.86 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.30% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 to 2034 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Handle Type, VehicleType, Sales Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Automotive Door Handles Market Companies

- CI Car International

- Dorman Products

- Guangzhou Yishan Auto Parts

- Huf

- OMIX

- Quadratec

- Magna International

- Minda VAST Access Systems

- Mitsui Mining and Smelting

- Kakihara Industries

- Sandhar

- Illinois Tool Works

Latest Announcement by Market Leaders

- In June 2024, Dorman Products, Inc. (NASDAQ: DORM) announced the release of hundreds of new aftermarket automotive components this week, further expanding its extensive catalog. With over 120,000 SKUs, Dorman offers a vast array of products, providing countless sales and repair opportunities across North America. Dorman’s latest releases include several first-to-aftermarket products designed to meet specific needs in the automotive sector:

- In February 2023, Magna announced it is investing more than USD 470 million to expand its operations across Ontario, Canada. The growth includes a new battery enclosures facility in Brampton to support the Ford F-150 Lightning and future OEM programs. In addition to the Brampton facility, Magna is growing in its locations in Guelph, Belleville, Newmarket, Windsor, and Penetanguishene.

Recent Developments

- In April 2023, Door handle manufacturer Emtek partnered with online furniture retailer Wayfair to offer Emtek’s products on Wayfair’s platform.

- In March 2023, Swedish lock manufacturer Assa Abloy acquired a British smart lock company, Danalock, to expand its smart lock product range.

- In February 2023, Door handle manufacturer Yale launched a new range of door handles with facial recognition technology.

Segments Covered in the Report

By Type

- Exterior Door Handles

- Interior Door Handles

By Handle Type

- Mechanical

- Automatic

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/