Automated Microbiology Market Size to Achieve USD 22.03 Billion by 2034

Automated Microbiology Market Size and Growth

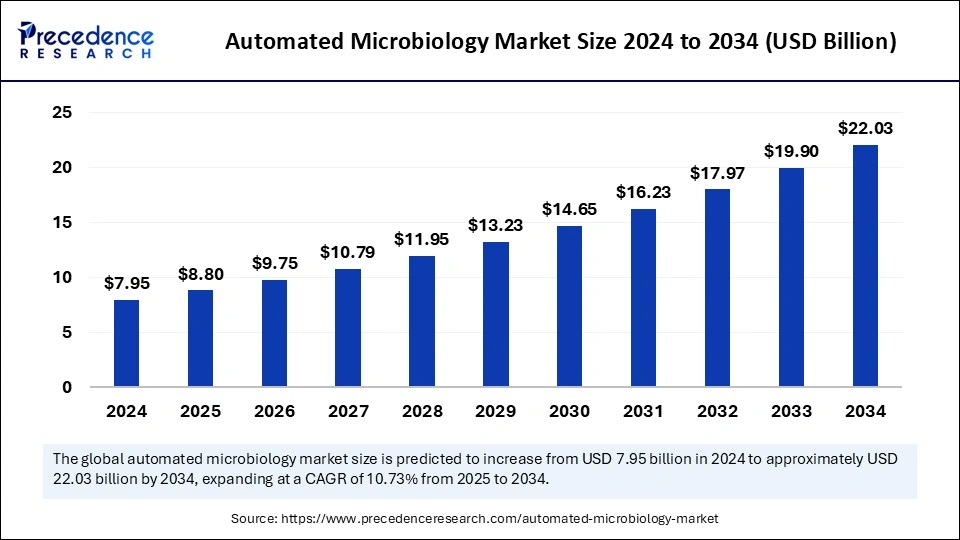

The global automated microbiology market size was valued at USD 7.95 billion in 2024 and is expected to achieve around USD 22.03 billion by 2034, a CAGR of 10.73%.

Key Takeaways

-

North America led the global market with a dominant share of more than 41% in 2024.

-

Asia Pacific is forecasted to grow at the most substantial CAGR over the projected period.

-

The reagents and kits segment held the top position, securing a 49% market share in 2024.

-

The instruments segment is poised to witness the most significant growth rate.

-

Fully automated systems emerged as the leading automation type in 2024.

-

The clinical diagnostics segment contributed the highest market revenue.

-

The biopharmaceutical production segment is anticipated to expand at the quickest CAGR.

-

Hospitals and diagnostic laboratories represented 45% of the overall market share in 2024.

-

Pharmaceutical and biotechnology companies are expected to grow at the highest rate during the forecast timeline.

AI Impact on the Automated Microbiology Market

Enhanced Diagnostic Accuracy

AI algorithms enhance the precision of microbial identification and susceptibility testing by analyzing complex datasets. This results in faster, more reliable diagnoses of infectious diseases, improving patient outcomes.

Automation of Laboratory Processes

AI streamlines laboratory workflows by reducing manual intervention and minimizing human errors. This automation boosts efficiency and supports high-throughput testing, making it invaluable in clinical microbiology.

Predictive Analytics

AI-driven data analysis helps forecast antibiotic resistance patterns, allowing healthcare professionals to make informed treatment decisions. This plays a crucial role in combating antimicrobial resistance (AMR) and optimizing antibiotic use.

Real-time Data Processing

AI enables continuous monitoring and real-time analysis of microbiological data, enhancing laboratory efficiency. Instant data processing allows for quicker clinical decision-making, improving the speed and accuracy of diagnoses.

Growth Factors of the Automated Microbiology Market

Advancements in AI and Automation

The integration of AI and automation is transforming microbiology by improving diagnostic precision, reducing manual errors, and accelerating microbial identification. These innovations streamline workflows and enhance high-throughput testing efficiency in clinical laboratories.

Rising Prevalence of Infectious Diseases

With the increasing global burden of infectious diseases, there is a growing need for faster and more accurate diagnostic solutions. Automated microbiology systems enable early disease detection, allowing timely treatment and reducing infection spread.

Growing Concern Over Antimicrobial Resistance (AMR)

The rise of antimicrobial resistance has heightened the demand for rapid and precise pathogen identification. Automated microbiology provides real-time insights into resistance patterns, assisting healthcare providers in selecting the most effective treatments.

Increased Adoption of High-Throughput Testing

Clinical laboratories and research institutions are embracing high-throughput microbiology solutions to handle large sample volumes efficiently. Automation enhances workflow efficiency, reducing turnaround times and improving diagnostic accuracy.

Rising Demand for Point-of-Care Testing (POCT)

The need for faster diagnostic solutions at the point of care is growing, especially in remote and resource-limited settings. Automated microbiology enables rapid and reliable testing, improving patient outcomes and expanding access to healthcare services.

Government and Private Sector Investments

Governments and private organizations are investing heavily in automated diagnostic technologies to improve healthcare infrastructure. Increased funding for research and development in microbiology automation is driving market growth.

Stringent Regulatory and Quality Requirements

Regulatory bodies emphasize standardized and accurate diagnostic procedures, pushing the adoption of automated microbiology solutions. These technologies ensure compliance with strict quality control standards, making them vital in clinical and pharmaceutical applications.

Expansion of Pharmaceutical and Biotechnology Industries

The rapid growth of the pharmaceutical and biotechnology sectors has fueled demand for advanced microbiology solutions. Automated systems play a crucial role in drug development, quality control, and contamination detection in pharmaceutical manufacturing

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/sample/5722

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 22.03 Billion |

| Market Size in 2025 | USD 8.80 Billion |

| Market Size in 2024 | USD 7.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.73% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Automation Type, Application, End use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East |

Automated Microbiology Market Dynamics

Drivers

Technological advancements in microbiology automation, including AI-powered diagnostics and robotic sample processing, are key drivers of market growth. The increasing burden of infectious diseases globally has heightened the demand for faster and more accurate diagnostic solutions. The growing emphasis on early disease detection and personalized medicine also fuels the adoption of automated microbiology.

Opportunities

The rise of smart laboratories and digitalized microbiology workflows presents significant opportunities for market growth. Increased collaborations between healthcare institutions and technology providers are paving the way for next-generation diagnostic solutions. Additionally, the growing awareness of antimicrobial resistance and infection control measures creates a need for advanced automated microbiology systems.

Challenges

One of the major challenges in the automated microbiology market is the high cost of advanced diagnostic systems, limiting accessibility in low-income regions. The lack of skilled personnel to operate sophisticated automated platforms is another concern. Additionally, maintaining compliance with changing regulatory frameworks can be complex for manufacturers and healthcare providers.

Regional Insights

North America leads the market due to its well-established healthcare infrastructure and high adoption rates of automated diagnostic solutions. Europe remains a significant player, supported by government initiatives promoting automation in laboratory testing. The Asia-Pacific region is experiencing rapid market growth, driven by increasing healthcare spending, population growth, and rising demand for efficient diagnostic tools.

Automated Microbiology Market Companies

- BD

- QIAGEN

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Danaher

- Merck KGaA

- bioMérieux

- Abbott

- DiaSorin S.p.A.

- BioRad Laboratories, Inc.

Latest Announcement by Market Leaders

- In February 2025, QIAGEN announced the official opening of a new data center in Melbourne, Australia, designed to strengthen its global bioinformatics leadership position in this region of the world. This latest addition reflects QIAGEN’s ongoing commitment to enhance its bioinformatics data infrastructure.

- In January 2025, Diatech Pharmacogenetics announced an expansion of its collaboration with Merck Serono Middle East Ltd., affiliates of Merck KGaA (“Merck”). The collaboration aims to improve patient access to RAS biomarker testing in Middle East and Africa. Targeted therapy against cancer may be used in combination with chemotherapy for patients with specific genetic mutations, such as KRAS, BRAF, and NRAS mutations.

Recent Developments

- In January 2024, Rapid Micro Biosystems, Inc. announced that Samsung Biologics has chosen the Growth Direct platform to automate its microbial quality control processes, enhancing efficiency, strengthening data integrity, and enabling scalable quality control operations.

- In November 2023, London Health Sciences Centre (LHSC) and St. Joseph’s Heath Care London (St. Joseph’s) unveiled the installation of a Total Laboratory Automation (TLA) system within the clinical microbiology laboratory. The TLA system is the first of its kind to be installed in the world, making London an international flagship site for innovation in clinical microbiology.

- In January 2023, BD (Becton, Dickinson, and Company) launched a robotic track system for its BD Kiestra microbiology laboratory solution, designed to automate specimen processing, potentially minimizing manual effort and reducing result turnaround time.

Segments Covered in the Report

By Product

- Instruments

- Automated Microbial Identification Systems

- Automated Blood Culture Systems

- Automated Colony Counters

- Automated Sample Preparation Systems

- Automated Antibiotic Susceptibility Testing (AST) Systems

- Other Instruments

- Reagents and Kits

- Culture Media

- Stains and Dyes

- Assay Kits and Panels

- Others

- Software

By Automation Type

- Fully Automated

- Semi-Automated

By Application

- Biopharmaceutical Production

- Clinical Diagnostics

- Environmental and Water Testing

- Food and Beverage Testing

- Other Applications

By End-use

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Academic and Research Institutes

- Other End Use

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Also Read: Canine Atopic Dermatitis Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/