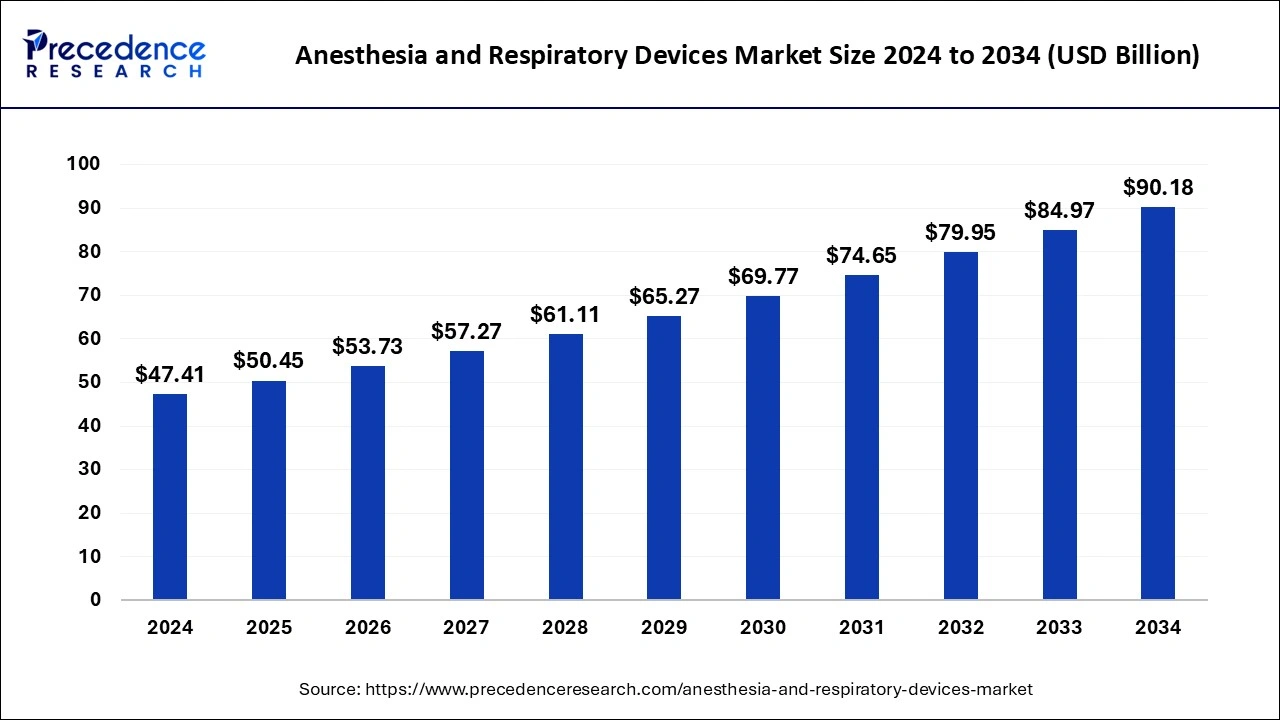

Anesthesia and Respiratory Devices Market Size to Attain USD 90.18 Bn by 2034

Anesthesia and Respiratory Devices Market

The anesthesia and respiratory devices market size is expected to attain around USD 90.18 billion by 2034 from USD 47.41 billion in 2024, with a CAGR of 6.64%.

Get Sample Copy of Report@ https://www.precedenceresearch.com/sample/1098

Key Points

- With a 26% revenue share, North America led the global market in 2024.

- Asia-Pacific is forecasted to grow at the highest CAGR in the coming years.

- The respiratory devices segment captured the largest market share by product in 2024.

Market Drivers

The rising incidence of respiratory disorders, particularly due to increasing air pollution and smoking habits, is a primary driver of market growth. Additionally, the COVID-19 pandemic significantly boosted the demand for respiratory support equipment, highlighting the critical need for ventilators and oxygen therapy devices.

The increasing adoption of minimally invasive surgeries has also contributed to the growth of anesthesia devices. Furthermore, continuous advancements in anesthesia monitoring technology, including automated drug delivery systems, are enhancing efficiency and safety.

Opportunities

The increasing demand for portable and wearable respiratory devices is creating new market opportunities. As more patients seek home-based treatments, compact and easy-to-use devices are gaining popularity. The expansion of telemedicine and remote monitoring solutions is also supporting the adoption of smart respiratory devices.

Furthermore, collaborations between medical device manufacturers and healthcare providers to develop cost-effective solutions for emerging markets are expected to drive industry growth.

Challenges

One of the major challenges in the market is the high cost of equipment, which restricts widespread adoption in developing regions. Inconsistent reimbursement policies for respiratory care devices can also hinder market expansion.

Additionally, technical issues such as device malfunctions or oxygen supply failures can pose risks to patient safety, leading to recalls and regulatory scrutiny. Competition from alternative therapies, including pharmaceutical treatments for respiratory conditions, presents another challenge for device manufacturers.

Regional Insights

North America continues to dominate the market, with a strong presence of key manufacturers, well-developed healthcare facilities, and high patient awareness. Asia-Pacific is expected to grow at the highest rate due to rising healthcare expenditures, increasing respiratory disease prevalence, and government initiatives to improve medical access.

European countries are focusing on sustainable and eco-friendly medical devices, contributing to steady market growth. Latin America and Africa are gradually improving their healthcare infrastructure, creating long-term market potential.

Anesthesia and Respiratory Devices Market Companies

- Masimo Corporation

- Medtronic

- AirSep Corporation

- Smiths Medical

- GE Healthcare

- Philips Healthcare

- Braun Medical Inc.

- Drägerwerk AG & Co

- KGaA

- Getinge AB

- Teleflex Inc

Recent Developments

- In October 2023, AirLife, a leading manufacturer and distributor of medical devices for anesthesia and respiratory care in North American, announced the completion of its respiratory business: BALLARD, MICROCUFF, and endOclear product lines, from Avanos Medical, Inc. The acquisition enables AirLife to enhance its product portfolio of anesthesia and respiratory care.

- In June 2023, Avanos Medical, Inc. agreed to sell its Regenerative Medicine (RH) business to SunMed Group Holdings, LLC (SunMed), a leading North American manufacturer and distributor of consumable medical devices for anesthesia and respiratory care.

- In March 2023, SunMed, a leading North American manufacturer and distributor of medical devices for anesthesia and respiratory care, announced a definitive agreement with Vyaire Medical, under which SunMed will acquire Vyaire’s business, which manufactures and sells respiratory and anesthesia supplies for airway management and surgical treatment.

Segments Covered in the Report

By Product

- Anesthesia Devices

- Machines

- Workstations

- Monitors

- Ventilators

- Delivery machines

- Standalone

- Portable

- Disposables

- Disposable Accessories

- Disposable Masks

- Machines

- Respiratory Devices

- Disposables

- Disposable Oxygen Masks

- Resuscitators

- Tracheostomy Tubes

- Oxygen Cannula

- Equipment

- Reusable Resuscitators

- Ventilators

- Adult Ventilators

- Neonatal ventilators

- Positive Airway Pressure

- Bi-level positive airway pressure devices

- Continuous positive airway pressure devices

- Nebulizers

- Pneumatic nebulizers

- Mesh nebulizers

- Ultrasonic nebulizers

- Inhalers

- Dry powdered inhalers

- Metered-dose inhaler

- Humidifiers

- Heat exchangers

- Pass over humidifiers

- Heat humidifiers

- Heated wire breathing circuits

- Oxygen Concentrators

- Portable oxygen concentrators

- Fixed oxygen concentrators

- Measurement Devices

- Spirometers

- Pulse Oximeters

- Capnography

- Peak Flow Meters

- Disposables

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/