Aluminum Composite Panel Market Size to Gain USD 12.82 Billion by 2034

Aluminum Composite Panel Market Size and Forecast 2025 to 2034

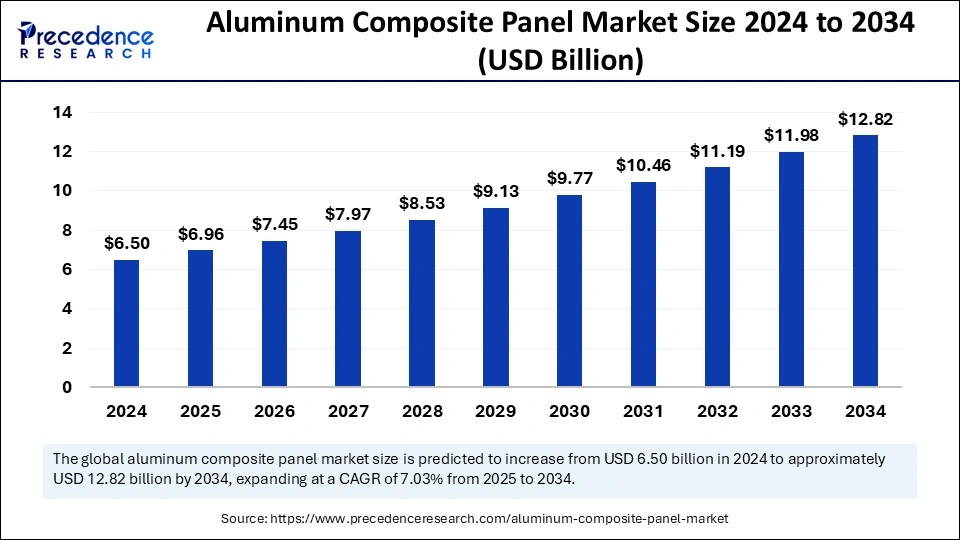

The global aluminum composite panel market size was estimated at USD 6.50 billion in 2024 and is expected to gain around USD 12.82 billion by 2034, growing at a CAGR of 7.03%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5819

Aluminum Composite Panel Market Key Points

-

Asia Pacific held the largest share of the global market in 2024, with 41%.

-

North America is likely to be the fastest-growing regional market in the near future.

-

Europe is also expected to show substantial growth during the forecast period.

-

Among product types, polyvinylidene fluoride commanded 37% of the market share.

-

Laminating coatings are anticipated to expand at a CAGR of 6.44%.

-

Construction applications dominated in 2024, making up 55% of total usage.

-

Advertising boards are on track for steady growth with a 6.54% CAGR.

Role of AI in Aluminum Composite Panel (ACP) Market

AI is playing a pivotal role in the advancement of the Aluminum Composite Panel (ACP) market, primarily by enhancing design, manufacturing processes, and quality control. AI-powered systems can optimize the production of ACPs by predicting material behavior, improving the efficiency of manufacturing lines, and minimizing waste during production. This not only increases the quality of the panels but also reduces operational costs and energy consumption.

Additionally, AI can assist in the design phase by utilizing machine learning algorithms to analyze architectural trends, customer preferences, and environmental factors to develop more sustainable and innovative ACP solutions. AI systems can also be integrated into monitoring systems for real-time inspection, ensuring that the panels meet the required quality standards. Through predictive maintenance, AI can forecast equipment failures and optimize maintenance schedules, thereby reducing downtime and enhancing production efficiency. As a result, AI is driving both innovation and operational excellence in the ACP market.

Aluminum Composite Panel (ACP) Market Growth Factors

The Aluminum Composite Panel (ACP) market is witnessing substantial growth, driven primarily by the expansion of the construction industry across both developed and emerging economies. ACPs are highly favored in modern architecture due to their lightweight nature, durability, and design flexibility, making them ideal for exterior cladding, roofing, and interior applications.

Rapid urbanization and growing infrastructure development projects have further boosted the demand for ACPs in various sectors, including transportation and signage, owing to their ease of installation and adaptability.

In addition to construction, the increasing emphasis on sustainability and energy efficiency is accelerating the adoption of ACPs. These panels provide thermal insulation, reduce energy consumption in buildings, and offer recyclability, making them attractive for environmentally conscious construction practices. Technological advancements have also played a significant role, with innovations such as fire-resistant and antibacterial ACPs enhancing safety and performance.

Moreover, the growth of the advertising and signage industry has contributed to ACP market expansion, as the panels offer smooth surfaces, excellent printability, and strong weather resistance—ideal features for outdoor displays. Collectively, these factors are expected to drive consistent growth in the ACP market over the coming years.

Market Overview

The aluminum composite panel market is experiencing substantial growth, driven by its wide range of applications in building facades, signage, interior decoration, and transportation. ACPs are known for their lightweight structure, high durability, and aesthetic appeal, making them a preferred material in modern construction and infrastructure projects. The market is also benefiting from innovations in surface coating technologies and fire-resistant materials, further expanding its scope across industrial and commercial uses.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.82 Billion |

| Market Size in 2025 | USD 6.96 Billion |

| Market Size in 2024 | USD 6.50 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.03% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

The increasing demand for energy-efficient and sustainable construction materials is a primary driver of the aluminum composite panel market. Rapid urbanization, particularly in emerging economies, has spurred infrastructure development, boosting the need for high-performance cladding solutions. Additionally, the rise in renovation and redevelopment projects worldwide contributes to market demand. Technological advancements, such as the use of PVDF-coated ACPs, have improved weather resistance and life span, further encouraging adoption.

Market Opportunities

There are several growth opportunities in the ACP market, including the rising emphasis on green building certifications and eco-friendly construction practices. The expansion of the advertising and signage industry, where ACPs are used for durable, vibrant displays, also presents a lucrative avenue. Moreover, demand for antibacterial and fire-retardant panels in sectors such as healthcare and public infrastructure is expected to create new prospects for manufacturers. Growing investments in smart city projects and urban infrastructure development across regions further support market growth.

Market Challenges

Despite its growth, the ACP market faces several challenges. Price volatility in raw materials, particularly aluminum, can impact production costs and profitability. Environmental concerns regarding the non-biodegradable core materials used in some ACPs also pose a challenge, along with increasing scrutiny over fire safety standards. Manufacturers must invest in R&D and compliance measures to address these issues while staying competitive in a fragmented and price-sensitive market.

Regional Insights

Asia Pacific held the largest share of the global ACP market in 2024, accounting for over 41% of the total market, owing to massive construction and infrastructure development in countries like China, India, and Southeast Asian nations. North America is expected to witness the fastest growth during the forecast period, driven by increasing investments in sustainable buildings and smart cities. Europe continues to show steady growth, supported by strong regulatory frameworks encouraging energy efficiency and aesthetic architecture in urban developments.

Recent Developments

- In February 2025, Viva ACP announced Bricklyn as the latest addition to their Santa Fe series, and Vive ACP is Asia’s largest aluminum composite panel manufacturer. Bricklyn was inspired by combining themes of modern design elements with the durability of real brick to provide a heritage loSok with modern technology.

- In November 2024, ALUCOBOND, the renowned Swiss-based 3A Composites brand, released “ALUCODUAL,” which entered the market as an innovation within its high-quality aluminum composite material offerings. The new ALUCODUAL product focuses on architectural applications because it targets scenarios needing advanced technological cladding solutions with exceptional design and performance capabilities.

- In June 2023, the new aluminum composite panels manufacturing plant of Alumaze opened its doors to operations in Visakhapatnam. Pawan Hirawat expressed that Alumaze established itself through 50 crore capital to produce ACP sheets at the Ravada hamlet of Bhogapuram in the Vizianagaram district.

Aluminum Composite Panel Market Companies

- 3A Composites GmbH

- Alcoa Corporation

- Alpolic Materials

- A strong Enterprises

- Alubond U.S.A.

- Aludecor Lamination Pvt. Ltd.

- Alumax Industrial Co., Ltd.

- Arconic Corporation

- Changshu Kaidi Decoration Co., Ltd.

- Fairfield Metal LLC

- Guangzhou Xinghe Co., Ltd.

- Jyi Shyang Industrial Co., Ltd.

- Mitsubishi Chemical Corporation

- Shanghai Huayuan Co., Ltd.

- Yaret Industrial Group Co., Ltd.

Segments Covered in the Report

By product

- PVDF

- Polyester

- Laminating coating

- Oxide film

- Others

By application

- Construction

- Automotive

- Cars

- Doors

- Hoods

- Wings

- Side panels

- Others

- Commercial vehicle

- Trailers

- Cars

- Advertising boards

- Railways

- Others

By region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Also Read: Magnesium Stearate Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/