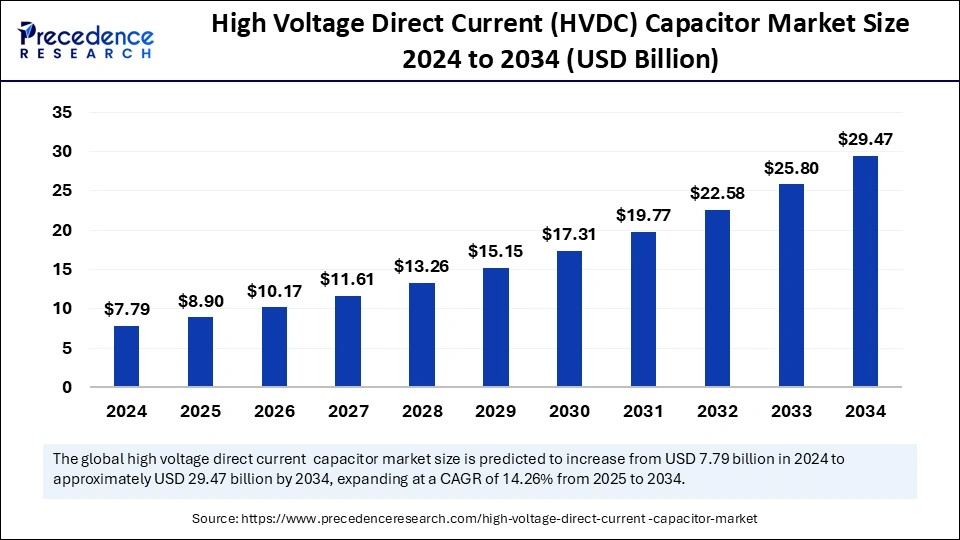

High Voltage Direct Current (HVDC) Capacitor Market Size to Gain USD 29.47 Bn by 2034

High Voltage Direct Current (HVDC) Capacitor Market Size and Forecast 2025 to 2034

The global high voltage direct current (HVDC) capacitor market size is accounted to gain around USD 29.47 billion by 2034 increasing from USD 7.79 billion in 2024, with a CAGR of 14.26%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5812

High Voltage Direct Current (HVDC) Capacitor Market Key Insights

-

Asia Pacific captured the lion’s share of the market in 2024, reaching 41%.

-

North America is on track to experience the strongest market growth moving forward.

-

Plastic film capacitors stood out as the leading product choice in 2024.

-

Ceramic capacitors are set to rise swiftly with the fastest CAGR through 2034.

-

The LLC technology segment maintained a strong presence in 2024.

-

VSC technology is projected to skyrocket in adoption during the coming years.

-

Open rack capacitor banks topped the charts for installation types in 2024.

-

Pole-mounted banks are expected to see robust growth ahead.

-

Energy and power applications were the main drivers of demand in 2024.

-

The industrial segment is predicted to surge with the fastest growth in the near term.

The Impact of Artificial Intelligence on the HVDC Capacitor Market

1. Enhanced Capacitor Design and Material Optimization

AI algorithms are being used to analyze complex datasets and improve capacitor designs. This includes optimizing dielectric materials, resulting in capacitors with better energy storage capacity, thermal performance, and longevity—key qualities for high-demand HVDC applications.

2. Real-Time Performance Monitoring and Predictive Maintenance

AI-powered monitoring systems enable real-time tracking of capacitor performance and identify anomalies instantly. Through predictive maintenance, these systems forecast potential failures, allowing timely intervention, which reduces downtime and maintenance costs—especially critical in large-scale HVDC transmission networks.

3. Optimization of Energy Storage and Discharge Cycles

AI improves the efficiency of energy storage and discharge processes within HVDC capacitors. This reduces power losses and ensures better energy stability, particularly important in renewable energy systems where power flow can be inconsistent.

4. Streamlined Manufacturing Processes

By integrating AI into manufacturing, companies are able to streamline production lines, enhance quality control, and reduce waste. This improves overall production efficiency and lowers costs while ensuring the capacitors meet high-performance standards.

High Voltage Direct Current (HVDC) Capacitor Market Growth Factors

-

Rising Demand for Long-Distance Power Transmission

The increasing need to transmit electricity across vast distances with minimal power loss is a significant growth driver. HVDC systems, supported by capacitors, are ideal for this purpose as they offer higher efficiency than traditional AC transmission. -

Surge in Renewable Energy Integration

The global shift toward renewable energy sources like solar and wind requires efficient grid integration. HVDC capacitors help stabilize voltage and enhance grid reliability, making them essential in renewable energy projects. -

Modernization of Power Infrastructure

Many countries are investing heavily in upgrading aging power infrastructure to meet growing energy demands. These upgrades often include the deployment of HVDC systems, boosting demand for advanced capacitors. -

Government Support and Regulations

Supportive government policies, incentives, and clean energy targets are encouraging the adoption of HVDC transmission lines, indirectly fueling the need for high-performance capacitors. -

Technological Advancements

Innovations in capacitor materials and designs—such as higher energy density, improved durability, and compact form factors—are enhancing performance and expanding application possibilities. -

Increased Focus on Energy Efficiency

With rising energy consumption and environmental concerns, there is a strong emphasis on reducing transmission losses. HVDC technology, supported by efficient capacitors, is seen as a solution to improve overall system efficiency. -

Urbanization and Industrialization in Emerging Economies

Rapid development in regions such as Asia-Pacific, the Middle East, and Africa is driving large-scale energy projects, creating significant demand for HVDC infrastructure and components like capacitors.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 29.47 Billion |

| Market Size in 2025 | USD 8.90 Billion |

| Market Size in 2024 | USD 7.79 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.26% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Technology, Installation Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Drivers

Rising focus on minimizing power losses, growing deployment of renewable energy, and increased interconnection of regional grids are key forces behind market growth. Government-led clean energy programs and utility modernization projects are further accelerating the adoption of HVDC systems.

Market Opportunities

Expanding demand for flexible and reliable energy transmission opens doors for innovation in capacitor technology. Markets in Africa, the Middle East, and Southeast Asia present untapped opportunities due to their ongoing infrastructure development and need for long-distance power transmission systems.

Challenges

Market players face cost-related barriers and long project implementation cycles. Additionally, the complexity of integrating HVDC with traditional AC infrastructure can cause operational delays. Limited local manufacturing capabilities in some regions can also restrict timely availability of components.

Regional Insights

Asia Pacific remains the largest market, thanks to significant government investments and infrastructure scale. North America shows promising growth, particularly in renewable-linked HVDC projects. Europe continues to invest in upgrading its interregional power networks, providing steady market growth opportunities.

High Voltage Direct Current (HVDC) Capacitor Market Companies

- Eaton Corporation PLC

- General Atomics Inc.

- General Electric Company

- Hitachi Ltd. (Hitachi ABB Power Grids Ltd)

- Murata Manufacturing Co. Ltd.

- Samwha Capacitor Co. Ltd.

- Siemens AG

- TDK Corporation

- UCAP Power Inc.

- Vishay Intertechnology Inc.

Recent Developments

- In February 2025, Bharat Heavy Electricals Limited (BHEL) received a Letter of Intent (LOI) from Rajasthan Part I Power Transmission Limited, awarding a consortium including BHEL and Hitachi Energy India Limited (HEIL) a project to design and execute an HVDC link to transmit renewable energy from Bhadla III in Rajasthan to Fatehpur in Uttar Pradesh.

- In November 2024, GE Vernova Inc. expanded its Electrification facility in Berlin by opening a High Voltage Direct Current (HVDC) Competence Center. This center will develop technology to enhance grid stability and integrate renewable energy across Germany and Europe.

- In January 2024, DNV launched a joint industry project (JIP) with ten offshore wind and transmission developers to update electrical standards, facilitating the integration of HVDC technology into the U.S. electric grid, which is essential for connecting clean energy sources.

- In March 2023, Hitachi Energy and Grid United announced a partnership to implement high-voltage direct current (HVDC) technology for projects interconnecting the eastern and western U.S. power grids. This initiative aims to increase transmission capacity to meet the growing demand for electricity.

Segments Covered in the Report

By Product Type

- Plastic Film Capacitors

- Aluminum Electrolytic capacitors

- Ceramic Capacitors

- Tantalum Wet Capacitors

- Reconstituted Mica Paper Capacitors

- Glass Capacitors

- Others

By Technology

- Line-Commutated Converter (LCC)

- Voltage-Source Converter (VSC)

By Installation Type

- Enclosed Rack Capacitor Banks

- Open Rack Capacitor Banks

- Pole-Mounted Capacitor Banks

By Application

- Aerospace and Defense

- Commercial

- Energy and Power

- Industrial

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: Multi-Mode Receiver Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/