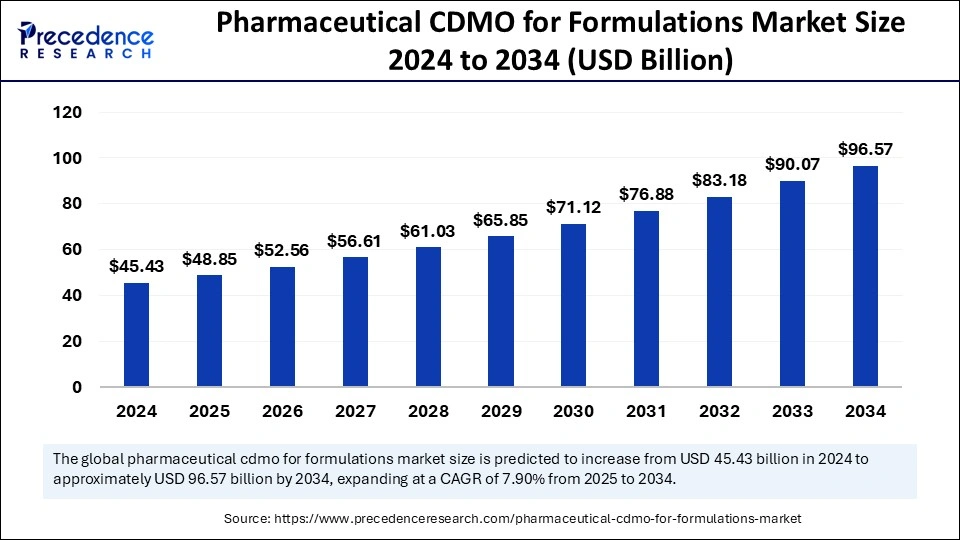

Pharmaceutical CDMO for Formulations Market Size to Surge USD 96.57 Billion by 2034

Pharmaceutical CDMO for Formulations Market Size and Forecast 2025 to 2034

The global pharmaceutical CDMO for formulations market size is expected to surge around USD 96.57 billion by 2034, increasing from USD 45.43 billion in 2024, with a CAGR of 7.90%.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/5785

Pharmaceutical CDMO for Formulations Market Key Takeaways

-

Asia Pacific held the largest slice of the market in 2024 with a dominant 42% share.

-

Europe is projected to experience notable growth at a CAGR of 8.40%.

-

Oral solids continue to be the top dosage form, commanding 40% of the market.

-

Injectables are expected to see impressive growth at 8.31% CAGR.

-

Oncology remained the top therapeutic category, representing 23% of the market.

-

Infectious diseases are gaining traction with an 8.02% CAGR outlook.

-

The pharmaceutical companies segment leads the end-user category with a 55% share.

-

Biopharmaceutical firms are on the rise, with forecasted growth at 8.17% CAGR.

AI Revolutionizing Pharmaceutical CDMOs for Formulations

Smart Formulation Development

Artificial Intelligence is redefining how pharmaceutical CDMOs approach drug formulation. By using advanced algorithms and predictive modeling, AI can simulate countless formulation combinations, optimize ingredient ratios, and ensure long-term stability—all before physical trials begin. This not only saves time but also cuts R&D costs dramatically while boosting formulation precision and success rates.

Precision Manufacturing & Smarter Operations

In manufacturing, AI steps in as the digital brain—monitoring operations in real time, predicting equipment failures, and maintaining strict quality standards. From automated batch processing to adaptive quality control, AI helps CDMOs improve product consistency, reduce downtime, and scale up with confidence. Plus, with AI-enhanced supply chain forecasting, companies can meet market demands faster and more efficiently than ever.

Pharmaceutical CDMO for Formulations Market Growth Factors

1. Rising Demand for Outsourced Drug Development

Pharmaceutical and biotech companies are increasingly outsourcing formulation and manufacturing processes to CDMOs to reduce costs, accelerate timelines, and focus on core competencies like R&D and marketing. This trend is especially strong among small to mid-sized firms with limited internal infrastructure.

2. Surge in Complex and Personalized Therapies

As the industry shifts toward more complex formulations—including biologics, injectables, and personalized medicines—CDMOs with advanced formulation expertise and adaptable technologies are in high demand. Their ability to manage sophisticated development processes makes them vital partners.

3. Expanding Biopharmaceutical Sector

The biopharma boom has significantly boosted the need for CDMOs with capabilities in sterile manufacturing, high-potency drugs, and large molecule formulations. Biopharma companies rely heavily on specialized CDMOs to manage strict regulatory demands and scale-up requirements.

4. Globalization and Market Expansion

Pharmaceutical companies are expanding into emerging markets, increasing the need for regionally compliant formulations. CDMOs with global manufacturing and regulatory capabilities are well-positioned to support localized product development and distribution.

5. Technological Advancements and AI Integration

The adoption of cutting-edge technologies such as AI, machine learning, and digital twins enhances formulation optimization, predictive analytics, and operational efficiency. These innovations help CDMOs offer faster, more accurate, and cost-effective solutions.

6. Stringent Regulatory Standards and Quality Requirements

Meeting the rising regulatory standards for drug quality, safety, and efficacy is challenging. CDMOs that invest in robust quality systems, GMP compliance, and regulatory support become preferred partners for pharmaceutical companies.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 96.57 Billion |

| Market Size in 2025 | USD 48.85 Billion |

| Market Size in 2024 | USD 45.43 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.90% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Dosage Form, Therapeutic Area, End-User, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

Key drivers include rising drug development costs, pressure to reduce time-to-market, and growing demand for specialized formulations. Outsourcing allows pharma companies to focus on core competencies while leveraging CDMO expertise.

Opportunities

There is a rising demand for innovative dosage forms and targeted therapies. Expanding biologics pipelines and investments in high-potency drug formulation services open new revenue streams. CDMOs that integrate digital technologies and flexible manufacturing platforms will be well-positioned.

Challenges

IP protection and compliance with global regulatory standards remain complex. Limited tech transfer capabilities and dependency on third-party vendors add risks, especially for emerging pharma players.

Regional Insights

Asia Pacific leads due to a favorable cost structure and a strong base of skilled labor. Europe is rapidly adopting advanced manufacturing technologies and partnering with local CDMOs to streamline production and distribution across the continent.

Pharmaceutical CDMO for Formulations Market Companies

- Lonza

- Thermo Fisher Scientific, Inc.

- Recipharm AB

- Laboratory Corporation of America Holdings (LabCorp)

- Catalent, Inc.

- WuXi AppTec, Inc.

- Piramal Pharma Solutions

- Siegfried Holding AG

- CordenPharma International

- Cambrex Corporation

- Bushu Pharmaceuticals Ltd.

- Nipro Corporation

- EuroAPI

- Hovione

- Curia

Latest Announcements by Industry Leaders

- In November 2024, John Rim, Samsung Biologics chief executive, stated that the company feels honored to improve its partnership with European pharmaceutical companies to jointly deliver high-quality biopharmaceutical treatment to patients. The strategic global partnerships invest in its technologies and manufacturing capabilities. We aim to provide the highest quality services at every stage and deepen our trusted partnerships.

Recent Developments

- In October 2023, Cambrex Corporation, centered in High Point, North Carolina (U.S.), finished its expansion project worth USD 38 million. The facility improvement delivered cutting-edge analytical laboratories as well as chemical development laboratories, new clinical production suites, and three work centers with 2,000 L reactors for small-scale commercial manufacturing.

Segments Covered in the Report

By Dosage Form

- Oral Solids

- Oral Liquids

- Injectables

- Topicals

- Inhalation Products

- Transdermal And Patches

- Others

By Therapeutic Area

- Oncology

- Cardiology

- Central Nervous System

- Gastroenterology

- Infectious Diseases

- Endocrinology (Diabetes, Hormonal Therapy)

By End User

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Also Read: CRISPR-Based Gene Editing Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/