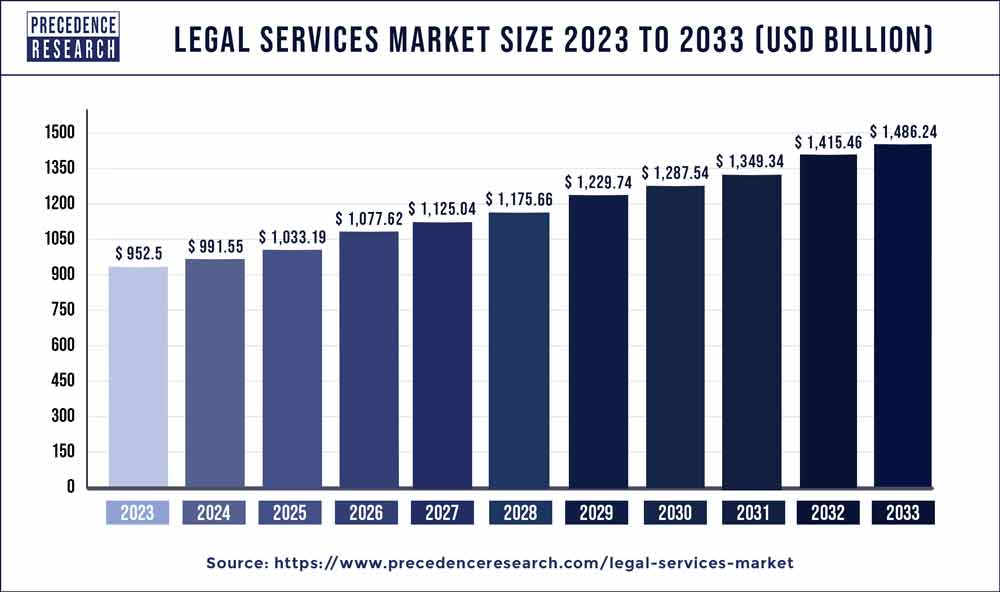

The global legal services market size surpassed USD 952.5 billion in 2023 and is expected to hit around USD 1,486.24 billion by 2033, growing at a CAGR of 4.60% from 2024 to 2033.

Table of Contents

ToggleKey Takeaways

- North America contributed more than 42% of market share in 2023.

- Asia-Pacific is estimated to expand at the fastest CAGR between 2024 and 2033.

- By service, the corporate segment has held the largest market share of 31% in 2023.

- By service, the litigation segment is anticipated to grow at a remarkable CAGR of 5.12% between 2024 and 2033.

- By firm size, the large firm segment generated over 39% of the market share in 2023.

- By firm size, the small law firms’ segment is expected to expand at the fastest CAGR over the projected period.

- By provider, the legal business firms segment generated over 48% of the market share in 2023.

- By provider, the private practicing attorneys segment is expected to expand at the fastest CAGR over the projected period.

Introduction:

The legal services market encompasses a broad spectrum of activities aimed at providing legal advice, representation, and support to individuals, businesses, and organizations. With the increasing complexity of laws and regulations across different sectors and jurisdictions, the demand for legal services continues to grow. This market includes various players, from individual practitioners to large law firms, offering a wide range of services such as litigation, corporate law, intellectual property rights, and regulatory compliance.

Get a Sample: https://www.precedenceresearch.com/sample/3696

Drivers:

Several factors drive the growth and evolution of the legal services market. One significant driver is the globalization of business activities, which leads to cross-border transactions and the need for legal expertise in navigating international laws and regulations. Additionally, advancements in technology have spurred demand for legal services related to data protection, cybersecurity, and intellectual property rights. Moreover, changes in regulatory frameworks, such as those related to environmental protection or financial services, create new opportunities for legal advisory and compliance services.

Region Snapshot

The legal services market varies in size, structure, and dynamics across different regions. In developed economies like the United States and Europe, large law firms dominate the market, offering specialized services to multinational corporations and high-net-worth individuals. Emerging markets in Asia, Latin America, and Africa are experiencing rapid growth in demand for legal services due to economic development, foreign investment, and regulatory reforms. Local firms in these regions are expanding their capabilities to cater to the evolving needs of domestic and international clients.

Legal Services Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 952.5 Billion |

| Global Market Size by 2033 | USD 1,486.24 Billion |

| U.S. Market Size in 2023 | USD 280.04 Billion |

| U.S. Market Size by 2033 | USD 445.39 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Service, By Firm Size, and By Provider |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Service

Legal services encompass a wide range of offerings tailored to meet diverse client needs. These services can include litigation and dispute resolution, corporate law, intellectual property law, real estate law, family law, and many others. Each service area requires specialized expertise and may cater to different clientele, from individuals seeking personal legal assistance to multinational corporations requiring complex legal counsel.

By Firm Size

Legal service providers vary greatly in size, ranging from solo practitioners to large multinational law firms. Solo practitioners typically offer personalized services and may specialize in niche areas of law. Small to medium-sized firms often provide a broad spectrum of legal services while maintaining a more localized or regional focus. Large firms, on the other hand, may have extensive resources, multiple practice areas, and a global presence, catering to complex legal needs of corporations and institutions.

By Provider

Legal services can be provided by a diverse array of entities beyond traditional law firms. Apart from lawyers in private practice, legal services are also offered by in-house counsel within corporations, government legal departments, legal aid societies, non-profit organizations, and alternative legal service providers (ALSPs) such as legal tech companies and legal process outsourcing (LPO) firms. Each provider type serves distinct client segments and addresses specific legal needs, contributing to the overall ecosystem of legal services.

Read Also: Metaverse in Gaming Market Size to Attain USD 525.51 Bn By 2033

Recent Developments

- In February 2023, Latham & Watkins provided legal counsel for Tactile Systems Technology, Inc.’s USD 32.5 million Public Offering of Common Stock. Tactile Systems Technology is a medical technology company dedicated to developing devices for treating patients with underserved chronic diseases at home.

- In October 2022, Kirkland & Ellis offered legal advice to Nordic Capital, a prominent European private equity investor, on the successful closure of the Nordic Capital Fund XI. The fund reached its hard cap, securing EUR 9 billion (USD 9.5 billion) in capital commitments, exceeding the initial target of EUR 8 billion. This fund is strategically focused on buyouts within Nordic Capital’s sectors of interest, including healthcare, technology, payments, financial services, and selectively in industrial and business services, reflecting a robust fundraising achievement within a nine-month timeframe.

Competitive Landscape:

The competitive landscape of the legal services market is characterized by intense competition among law firms, legal consultancies, and in-house legal departments. Large multinational law firms compete for market share by offering comprehensive services, leveraging their global networks, and recruiting top legal talent. Boutique firms focus on niche practice areas and provide specialized expertise to targeted client segments. Additionally, alternative legal service providers, including legal process outsourcing firms and technology-driven platforms, are disrupting traditional models by offering cost-effective solutions and innovative service delivery methods. As clients demand greater efficiency, transparency, and value from their legal service providers, competition in the market is driving firms to adapt their strategies, embrace technology, and differentiate their offerings to stay ahead in the increasingly dynamic and competitive landscape.

Legal Services Market Companies

- Baker McKenzie

- DLA Piper

- Clifford Chance

- Skadden, Arps, Slate, Meagher & Flom

- Allen & Overy

- Linklaters

- Freshfields Bruckhaus Deringer

- Latham & Watkins

- Kirkland & Ellis

- Jones Day

- Hogan Lovells

- White & Case

- Sidley Austin

- Mayer Brown

- Norton Rose Fulbright

Segments Covered in the Report

By Service

- Taxation

- Real Estate

- Litigation

- Bankruptcy

- Labor/Employment

- Corporate

By Firm Size

- Large Firms

- Medium Firms

- Small Firms

By Provider

- Private Practicing Attorneys

- Legal Business Firms

- Government Departments

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/