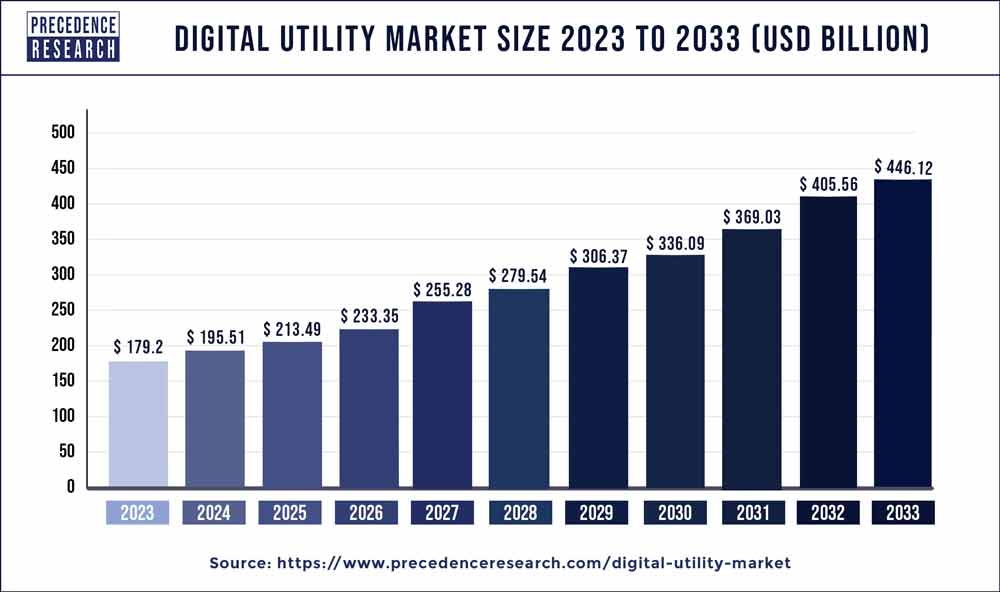

Digital Utility Market Size To Worth USD 446.12 Billion By 2033

The global digital utility market size is expected to surpass around USD 446.12 billion by 2033 from USD 179.2 billion in 2023 and is poised to grow at a CAGR of 9.60% from 2024 to 2033.

Table of Contents

ToggleKey Takeaways

- North America contributed more than 31% of market share in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By network, the transmission & distribution segment has held the largest market share of 47% in 2023.

- By network, the retail segment is anticipated to grow at a remarkable CAGR of 12.9% between 2024 and 2033.

- By technology, the hardware segment generated over 62% of market share in 2023.

- By technology, the integrated solutions segment is expected to expand at the fastest CAGR over the projected period.

Introduction:

The digital utility market is at the forefront of transforming traditional utility services through the integration of advanced digital technologies. As the world becomes increasingly interconnected, utilities are adopting digital solutions to enhance operational efficiency, optimize resource utilization, and meet the rising demand for sustainable energy. This market encompasses a wide range of technologies, including smart grids, advanced metering infrastructure, and data analytics, revolutionizing the way utilities generate, distribute, and manage energy resources.

Get a Sample: https://www.precedenceresearch.com/sample/3684

Drivers

Several key drivers are propelling the growth of the digital utility market. One primary driver is the urgent need for utilities to modernize their infrastructure to meet the evolving energy landscape. The integration of renewable energy sources, coupled with the demand for real-time monitoring and control, is compelling utilities to invest in digital solutions. Additionally, the emphasis on reducing carbon footprints and enhancing energy efficiency is driving the adoption of smart grids and other digital technologies. The push towards decentralization and the increasing importance of grid reliability further contribute to the momentum of the digital utility market.

Region Snapshot

The adoption of digital utility solutions is not uniform across regions, with variations influenced by regulatory frameworks, infrastructure development, and economic factors. Developed regions such as North America and Europe have been early adopters, driven by regulatory initiatives promoting smart grid implementation and environmental sustainability. In emerging economies of Asia-Pacific, the focus is on infrastructure development to meet the growing energy demand, leading to substantial investments in digital utility solutions. The Middle East and Africa are also witnessing increased interest, driven by the need for efficient utility management in rapidly urbanizing areas.

Digital Utility Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 9.60% |

| Global Market Size in 2023 | USD 179.2 Billion |

| Global Market Size by 2033 | USD 446.12 Billion |

| U.S. Market Size in 2023 | USD 38.89 Billion |

| U.S. Market Size by 2033 | USD 98.59 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Network and By Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Network:

The Digital Utility Market, when segmented by network, typically refers to the different types of communication infrastructures and networks that enable the seamless flow of information and data within the utility ecosystem. One prominent segment is the Smart Grid, characterized by advanced metering infrastructure (AMI), sensors, and communication networks that facilitate real-time data exchange. Smart grids enhance efficiency, reliability, and responsiveness in energy distribution, allowing utilities to monitor and manage the grid more effectively.

Another key segment is the Communication Networks, which involve the various communication technologies used for data transmission. This includes wired (fiber optics, powerline communication) and wireless (5G, IoT) networks. These networks play a crucial role in connecting smart devices, enabling remote monitoring, and supporting the integration of renewable energy sources into the grid.

By Technology:

The segmentation of the Digital Utility Market by technology focuses on the innovative tools and solutions leveraged by utility companies to enhance their operations. Advanced Metering Infrastructure (AMI) stands out as a significant segment within this category. AMI incorporates smart meters that provide real-time consumption data, enabling consumers to make informed decisions about their energy usage and allowing utilities to optimize resource allocation.

Grid Optimization Technologies form another vital segment, encompassing software and hardware solutions that enhance grid performance. This includes Distribution Management Systems (DMS) and Outage Management Systems (OMS), which help utilities detect and respond to issues swiftly, minimizing downtime and improving overall grid reliability.

Renewable Energy Integration technology is a growing segment, addressing the integration of renewable energy sources like solar and wind into the traditional grid. This involves technologies such as energy storage systems, demand response solutions, and smart inverters, ensuring a smooth integration of clean energy and promoting sustainability.

Read Also: Adaptive AI Market Size To Rise USD 24.63 Billion By 2033

Recent Developments

- In May of 2023, Siemens, the renowned German manufacturing company, unveiled its latest offering, Industrial Operations X. This innovative portfolio empowers users to effortlessly integrate hardware and software components, enabling operational technology (OT) to adapt swiftly to the pace of software advancements.

- In September 2021, Innowatts, an artificial intelligence firm, joined forces with Amazon Web Services to propel the digital transformation of energy providers. By harnessing the full potential of cloud-based and highly scalable data analytics, Innowatts aims to process over 4 billion data points per hour. This initiative seeks to provide the utility industry with enhanced transparency in their operations.

Competitive Landscape:

The digital utility market is characterized by intense competition among key players striving to innovate and gain a competitive edge. Major multinational corporations and niche players contribute to the diverse landscape, offering a range of solutions from advanced metering systems to comprehensive energy management platforms. Partnerships and collaborations between utilities and technology providers are common strategies to leverage expertise and enhance market presence. Key players focus on research and development to introduce cutting-edge solutions, while mergers and acquisitions are prevalent to consolidate market share and expand geographical reach. As the digital utility market evolves, the competitive landscape is expected to witness dynamic shifts driven by technological advancements and strategic alliances.

Digital Utility Market Companies

- General Electric

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- IBM Corporation

- Cisco Systems, Inc.

- Oracle Corporation

- Itron, Inc.

- Honeywell International Inc.

- Eaton Corporation

- Landis+Gyr AG

- Sensus (Xylem Inc.)

- Huawei Technologies Co., Ltd.

- Toshiba Corporation

- Aclara Technologies LLC

Segments Covered in the Report

By Network

- Generation

- Transmission & Distribution

- Retail

By Technology

- Hardware

- Integrated Solutions

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/