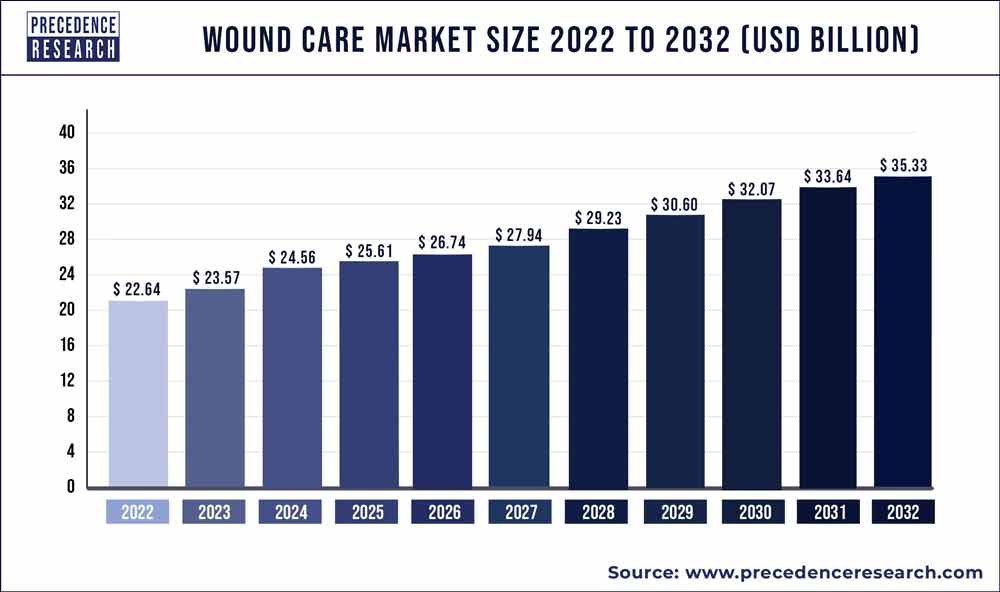

Wound Care Market will be Worth Nearly $ 35.33 Billion By 2032

Key Takeaways

- North America contributed more than 46% of revenue share in 2022.

- Asia Pacific is estimated to expand the fastest CAGR between 2023 and 2032.

- By application, the chronic segment has held the largest market share of 75% in 2022.

- By application, the acute segment is anticipated to grow at a remarkable CAGR of 5.1% between 2023 and 2032.

- By end-use, the hospital segment generated over 39% of revenue share in 2022.

- By end-use, the home care segment is expected to expand at the fastest CAGR over the projected period.

- By product, the advanced wound dressing segment generated over 34% of revenue share in 2022.

- By product, the surgical wound care segment is expected to expand at the fastest CAGR over the projected period.

- By mode of purchase, the prescribed segment generated over 65% of revenue share in 2022.

- By mode of purchase, the non-prescribed (OTC) segment is expected to expand at the fastest CAGR over the projected period.

The Wound Care Market is a dynamic sector within the healthcare industry dedicated to the treatment and management of various types of wounds. This encompasses a wide range, from surgical wounds to chronic wounds like ulcers. With a growing aging population and an increase in chronic diseases, the demand for advanced wound care solutions has surged. Wound care involves a multidisciplinary approach, integrating medical professionals, technology, and innovative products to enhance the healing process and improve patient outcomes.

Get a Sample: https://www.precedenceresearch.com/sample/3616

Drivers:

- Technological Advancements: The Wound Care Market is witnessing significant strides in technology, with the development of advanced dressings, bioactive materials, and smart bandages. These innovations aim to accelerate the healing process, reduce infection risks, and provide more personalized care.

- Rising Chronic Diseases: The prevalence of chronic diseases such as diabetes, obesity, and cardiovascular conditions contributes to an increased incidence of chronic wounds. As these conditions become more widespread, the demand for effective wound care solutions continues to grow.

- Aging Population: With a globally aging population, there is a higher likelihood of age-related conditions and the subsequent need for surgical interventions. This demographic shift propels the demand for wound care products and services, as elderly individuals often face challenges in the natural healing process.

- Increasing Awareness: There is a growing awareness among both healthcare professionals and the general public regarding the importance of proper wound care. This increased awareness results in early intervention, promoting better wound healing outcomes and reducing the overall economic burden on healthcare systems.

- Globalization and Market Expansion: The Wound Care Market is expanding globally, driven by the rise in healthcare infrastructure development, increased healthcare spending, and the accessibility of advanced wound care products in emerging markets. This globalization opens up new opportunities for market players to reach a wider customer base.

Wound Care Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 23.57 Billion |

| Market Size by 2032 | USD 35.33 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.40% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Application, By End-use, By Product, and By Mode of Purchase |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Blood Culture Test Market to Earn USD 16.31 Billion in Size By 2032

By Application:

- Chronic

- Acute

Wound care products cater to a diverse range of applications, addressing various types of injuries and wounds. Acute wounds, including surgical wounds and traumatic injuries, represent a significant segment. The market also focuses on chronic wounds, such as diabetic ulcers and pressure sores, where advanced wound care solutions play a crucial role in promoting healing. Additionally, wound care products find applications in managing burns, ensuring a comprehensive approach to different healthcare needs.

By End-use:

- Hospitals

- Specialty Clinics

- Home Healthcare

- Physician’s Office

- Nursing Homes

- Others

End-use segments in the wound care market encompass a wide spectrum of healthcare settings. Hospitals and specialty clinics constitute major consumers of wound care products, relying on advanced dressings, grafts, and other innovations to enhance patient outcomes post-surgery or injury. Home healthcare settings are gaining prominence, emphasizing the need for user-friendly and effective wound care solutions that patients can manage independently. Long-term care facilities also contribute significantly to the end-use landscape, emphasizing the market’s adaptability to varied healthcare environments.

By Product:

- Advanced Wound Dressing

- Surgical Wound Care

- Traditional Wound Care

- Wound Therapy Devices

Wound care products span a diverse array of offerings, including dressings, bandages, topical agents, and advanced wound care therapies. Traditional dressings like gauze and adhesive bandages continue to be staples in the market, offering cost-effective solutions for basic wound management. Advanced wound care products, such as hydrocolloids, hydrogels, and antimicrobial dressings, cater to more complex wounds, fostering accelerated healing and minimizing infection risks. The product landscape reflects a balance between established, essential items and cutting-edge innovations.

By Mode of Purchase:

- Prescribed

- Non-prescribed (OTC)

The mode of purchase in the wound care market varies to accommodate the preferences and needs of both healthcare professionals and consumers. Direct procurement through healthcare facilities and institutions remains a prevalent mode, ensuring a streamlined supply chain for essential wound care products. With the rise of e-commerce and online pharmacies, consumers increasingly opt for the convenience of purchasing wound care products online. This shift reflects a broader trend in healthcare consumerism, emphasizing accessibility and the ease of obtaining necessary medical supplies.

Recent Developments

- In April of 2021, 3M Company introduced the 3M Spunlace Extended Wear Adhesive Tape on Liner, 4576, boasting an extended wear time of 21 days to enhance user compliance and offer both health and economic advantages.

- In May 2021, Smith & Nephew unveiled ARIA Home PT, a component of the ARIA suite of solutions, introducing a remote physical therapy product.

- In March 2020, Cardinal Health released a surgical drape featuring Avery Dennison’s patented BeneHold CHG adhesive technology. This innovation is designed to mitigate the risk of surgical site contamination.

Wound Care Market Players

- 3M Company

- Smith & Nephew plc

- Johnson & Johnson

- Mölnlycke Health Care

- Coloplast A/S

- ConvaTec Group plc

- B. Braun Melsungen AG

- Medtronic plc

- Acelity L.P. Inc.

- Integra LifeSciences Corporation

- Ethicon, Inc. (a subsidiary of Johnson & Johnson)

- Derma Sciences, Inc. (acquired by Integra LifeSciences)

- Misonix, Inc.

- Organogenesis Holdings Inc.

- Hollister Incorporated

Segments Covered in the Report

By Application

- Chronic

- Acute

By End-use

- Hospitals

- Specialty Clinics

- Home Healthcare

- Physician’s Office

- Nursing Homes

- Others

By Product

- Advanced Wound Dressing

- Surgical Wound Care

- Traditional Wound Care

- Wound Therapy Devices

By Mode of Purchase

- Prescribed

- Non-prescribed (OTC)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/