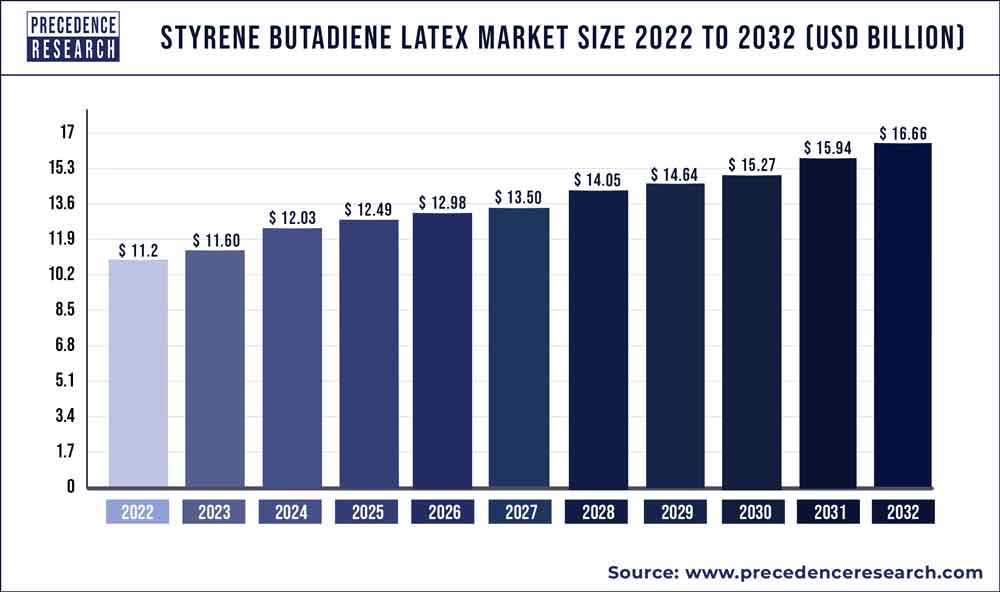

Styrene Butadiene Latex Market Size To Grow USD 16.66 Billion by 2032

The styrene butadiene latex market size is poised to grow by $ 16.66 billion by 2032 from $ 11.60 billion in 2023, exhibiting a CAGR of 4.10% during the forecast period 2023 to 2032.

Key Takeaways

- Europe contributed more than 35% of revenue share in 2022.

- North America is estimated to expand the fastest CAGR between 2023 and 2032.

- By type, the emulsion styrene butadiene latex segment has held the largest market share of 72% in 2022.

- By type, the solution styrene butadiene latex segment is anticipated to grow at a remarkable CAGR of 5.9% between 2023 and 2032.

- By application, the paper processing segment generated over 28% of revenue share in 2022.

- By application, the mortar additives segment is expected to expand at the fastest CAGR over the projected period.

- By butadiene content, the low segment generated over 38% of revenue share in 2022.

- By butadiene content, the high segment is expected to expand at the fastest CAGR over the projected period.

The Styrene Butadiene Latex Market is witnessing significant growth fueled by its versatile applications across various industries. Styrene butadiene latex, commonly known as SB latex, is a synthetic polymer emulsion that finds extensive use in the production of adhesives, coatings, and various types of latex products. This market’s dynamic nature is characterized by the ever-growing demand for eco-friendly alternatives, driving manufacturers to explore and innovate within the realm of styrene butadiene latex.

Get a Sample: https://www.precedenceresearch.com/sample/3578

Drivers

One of the primary drivers propelling the Styrene Butadiene Latex Market is its widespread adoption in the construction sector. SB latex is a key component in the formulation of construction adhesives and sealants, contributing to its high demand as infrastructure development continues globally. Additionally, the emphasis on sustainable and environmentally friendly products has led to an increased preference for water-based latex solutions, further boosting the market.

Moreover, the automotive industry plays a pivotal role in driving the demand for styrene butadiene latex, particularly in the manufacturing of carpet and interior components. The material’s ability to enhance durability and performance while maintaining cost-effectiveness aligns with the automotive sector’s evolving needs. As the emphasis on fuel efficiency and lightweight materials intensifies, styrene butadiene latex emerges as a favored choice.

Styrene Butadiene Latex Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 11.30 Billion |

| Market Size by 2032 | USD 16.66 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.10% |

| Largest Market | Europe |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Type, By Application, and By Butadiene Content |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Type:

- Emulsion Styrene Butadiene Latex

- Solution Styrene Butadiene Latex

Styrene Butadiene Latex is available in various types, each tailored to meet specific industry requirements. One common type is the carboxylated styrene-butadiene latex, known for its excellent adhesive properties and stability. Another variant is the high-solid styrene-butadiene latex, valued for its higher solid content, making it suitable for applications where a thicker coating is desired. Each type caters to different industries and applications, contributing to the overall adaptability of Styrene Butadiene Latex.

By Application:

- Paper Processing

- Fiber and Carpet Processing

- Glass Fiber Processing

- Paints and Coatings

- Adhesives

- Mortar Additives

- Foams and Mattresses

- Others

The applications of Styrene Butadiene Latex span across a wide range of industries, making it a highly sought-after product. In the paper industry, SBL is utilized for its binding properties in coating formulations, enhancing the quality and performance of paper products. Additionally, the carpet industry benefits from the latex’s adhesive characteristics, providing durability and resilience to carpets. The construction sector employs SBL in waterproofing membranes, ensuring robust protection against moisture. The diverse range of applications underscores the flexibility and utility of Styrene Butadiene Latex in various industrial sectors.

By Butadiene Content:

- Low

- Medium

- High

The butadiene content in Styrene Butadiene Latex plays a crucial role in determining its physical and chemical properties. Latex with higher butadiene content tends to exhibit greater flexibility and resilience, making it suitable for applications where these characteristics are essential, such as in the production of flexible coatings and adhesives. On the other hand, lower butadiene content in SBL may be preferred in applications where rigidity and hardness are desired. The ability to tailor the butadiene content allows manufacturers and end-users to select the most suitable variant based on the specific requirements of their intended applications.

Read Also: Home Spirometer Market Size To Attain USD 1.62 Billion By 2032

Recent Developments

- In July 2023, Synthomer, a prominent player in specialty chemicals, revealed its acquisition of Kraton Performance Polymers, a leading producer of styrene block copolymers (SBCs) and engineered polymers. This strategic move is anticipated to bolster Synthomer’s position in the Styrene Butadiene (SB) latex market by broadening its product portfolio and geographical reach.

- In June 2023, Trinseo, a global leader in latex binders and polymers, joined forces with BASF, a major chemical company, to collaborate on developing next-generation Styrene Butadiene Rubber (SBR) tailored for the paper and packaging industry. This collaborative partnership aims to innovate and introduce new SBR formulations with enhanced performance and a focus on sustainability, signaling a commitment to advancing materials in the evolving landscape of the latex market.

Styrene Butadiene Latex Market Players

- BASF SE

- Styron LLC (Trinseo)

- Dow Chemical Company

- Synthomer plc

- LANXESS AG

- Omnova Solutions Inc.

- LG Chem Ltd.

- JSR Corporation

- Wacker Chemie AG

- Sibur International GmbH

- Zeon Corporation

- Kumho Petrochemical Co., Ltd.

- Eastman Chemical Company

- Arkema S.A.

- Daelim Industrial Co., Ltd.

Segments Covered in the Report

By Type

- Emulsion Styrene Butadiene Latex

- Solution Styrene Butadiene Latex

By Application

- Paper Processing

- Fiber and Carpet Processing

- Glass Fiber Processing

- Paints and Coatings

- Adhesives

- Mortar Additives

- Foams and Mattresses

- Others

By Butadiene Content

- Low

- Medium

- High

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/